However, treasury shares also have risks, especially regarding liquidity and short-term stock price fluctuations. Therefore, when investors see a company announcing a treasury stock program, they should consider the company’s motivation and the market situation rather than unthinkingly following the trend. When a company decides to repurchase treasury stock, it often requires a significant cash outlay.

Example showing the journal entry for treasury shares using the par value method

This can be matched with static or increased demand for the shares, which also has an upward pressure on price. The increase is usually temporary and considered to be artificial as opposed to an accurate valuation of the company. Also known as a follow-on offering or subsequent offering, the secondary offering will occur when a company again places these shares on the market, thus re-diluting existing shares.

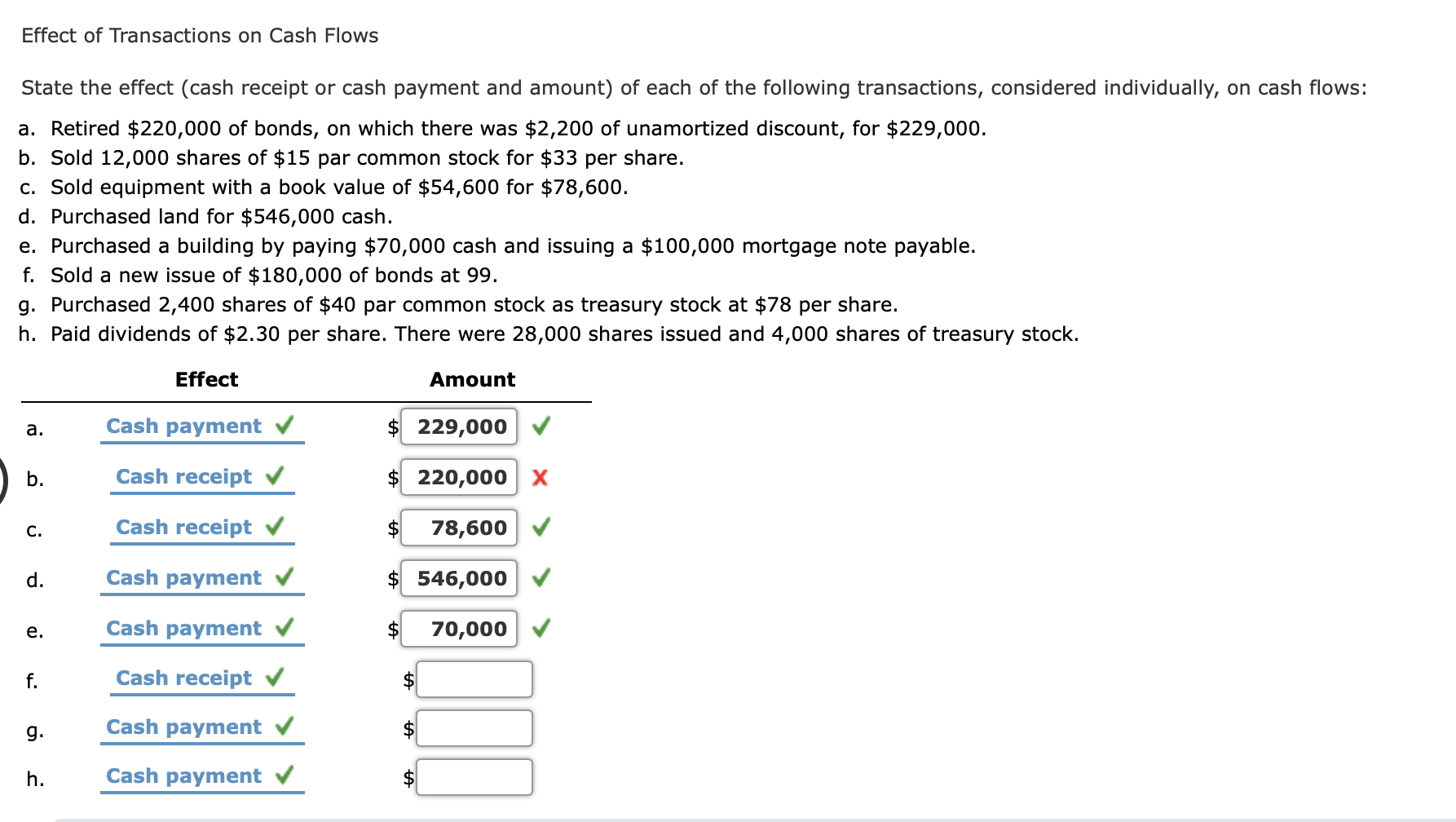

Retirement of treasury stock

When companies repurchase shares, they reduce the number of outstanding shares, which can drive up earnings per share (EPS) and increase stock value, making it an attractive strategy for those companies looking to reward investors. Many companies buy back their own shares with retained earnings for a variety of reasons. For example, if the company believes that its shares are trading for less than their intrinsic value, it may choose to use more of its earnings to acquire its own stock at a discount, as opposed to simply paying dividends. Likewise, the company ABC can record the $500,000 in the journal entry as the increase of treasury stock without concerning what is the par value or what is the original issued price of the stock. The journal entry for retiring treasury stock may be different from one company to another depending on whether the reacquisition cost of such stock is more or less than the amount the company received when the stock was originally issued. Assume the total sum of ABC Company’s equity accounts including common stock, APIC, and retained earnings was $500,000 before the share buyback.

Table of Contents

Over time, the company believes that its stock is undervalued and decides to repurchase 2 million shares at a price of $60 per share. These repurchased shares, now held as treasury stock, no longer count as outstanding shares. By contrast, under the par value method, share buybacks are recorded by debiting the treasury stock account by the shares’ total par value.

Get in Touch With a Financial Advisor

This method encourages employees to stick with the company for the long term. In addition, the applicable additional paid-in capital (APIC) or the reverse (i.e. discount on capital) must be offset by a credit or debit. On the cash flow statement, the share repurchase is reflected as a cash outflow (“use” of cash). Treasury shares Treasury shares are shares of a company’s stock that are owned in the company’s “treasury.” There are two main ways shares end up in the treasury. These 100,000 shares were originally issued at $3 per share and they have the par value of $1 per share. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Although treasury stock and common stock both represent shares in a company, they serve very different purposes and have distinct roles in a company’s financial structure. Stock is repurchased from the money saved in the company’s retained earnings, or else a company can fund its buyback by taking on debt through bond issuance. After the stock is repurchased, the issuer or transfer agent acting on behalf of the share issuer must follow a number of Securities and Exchange Commission rules. Any difference between the reacquisition price and the selling price is either an increase in paid-in capital (if the shares sold at a gain) or a decrease in paid-in capital and/or retained earnings (if the shares sold at a loss). Treasury stock is not considered an asset; it is a reduction in stockholders’ equity.

If you’re interested in finding a company’s treasury stock, look under the shareholders’ equity section of its balance sheet. Treasury stock is a contra equity account recorded in the shareholders’ equity section of the balance sheet. Because treasury stock represents the number of shares repurchased from the open market, it reduces perpetual inventory methods and formulas shareholders’ equity by the amount paid for the stock. The company can hold treasury stock for future purposes, such as reissuing shares, or it can retire them to permanently reduce the number of shares in circulation. Unlike common stock, treasury stock is recorded as a reduction in shareholders’ equity on the balance sheet.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

They claimed that the cancellation of 1 billion shares served as a symbolic gesture, commemorating the company’s successful completion of a groundbreaking project. In the UK, the Companies Act 1955 disallowed companies from holding their own shares. Finally, transfer agents must write and follow a set of procedures on how to deal with canceled or otherwise terminated stock. It is worth noting that the SEC does not mean to interfere with scripophily, but has to institute regulations in order to prevent fraud and theft. The Inflation Reduction Act was passed in August 2022, which stipulates that public domestic companies must pay a 1% excise tax on stock buybacks starting after Dec. 31, 2022. In this case, Paid-in Capital From Sale of Treasury Stock Above Cost is debited for only $3,000 (i.e., the balance in this account that resulted from the previous resale).

- This right may vest with time, allowing employees to gain control of this option after working for the company for a certain period of time.

- With fewer shareholders, it becomes harder for buyers to acquire the amount of stock necessary to hold a majority ownership position.

- Some shareholders’ shorter-term horizons may not view the event as a positive.

- This expenditure can impact the company’s liquidity, particularly in the short term, as cash flow may become tighter.

- A tender offer involves buying shares back from investors above the market price or at a premium.

Using this method, the cost of the treasury stock is listed in the stockholders’ equity portion of the balance sheet. When a company buys back its shares, they are recorded in its account and can be converted to preferred shares or bonds at any time. This makes treasury shares a powerful tool for navigating market volatility and responding to various situations.

Leave a Reply