Comparing Credit Unions to help you Old-fashioned Banking companies

Selecting the right financial institution is very important, because after the day, men and women wants good financial companion to hold the hard-made currency. , a lot of people commonly pick anywhere between a lender and you will a credit union. Although they may sound similar at first glance, you will find several a whole lot more nuanced variations you to we will undergo less than:

Possession

One of the primary differences between financial institutions and you may borrowing unions is the control framework. Banks is actually belonging to people, that have an aim of promoting payouts to the investors. Oversight from corporate banking surgery is provided from the a board out of Directors just who drive the financial institution into earnings. Additionally, borrowing unions are not-for-earnings financial cooperatives and you may owned by the players. That usually means borrowing unions render less expensive banking selection, best prices toward deals, superior assistance and services on their people – who will be also the investors and therefore are supportive of its local groups. Borrowing Unions is actually furthermore governed of the a panel loans Orange City regarding Directors, however they are elected because of the borrowing connection participants. This compare away from control and you will governance of banks instead of credit unions typically contributes to a better, so much more custom banking sense out-of borrowing from the bank unions.

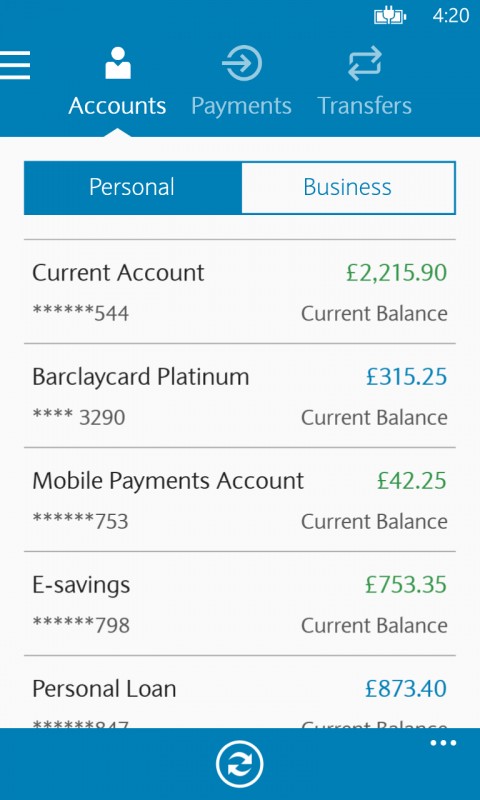

Financial Issues

Nowadays, extremely borrowing unions promote all of the exact same products and services as their financial counterparts. But not, they normally are confronted with high pricing with the savings accounts minimizing prices towards the finance.

Interest rates

As stated, credit unions generally render all the way down interest rates towards the loans, than simply traditional banking institutions. Why does that work? Because the credit unions are low-cash, they often times use the profits’ from items and make use of these to promote less interest levels. That is one of the several aggressive positives you to borrowing unions possess more traditional banks.

Banking Costs

While the borrowing from the bank unions exist to simply help its users flourish economically, they’re going to typically bring smaller fees because of their members, including 100 % free characteristics in some instances. Antique banks routinely have some sort of fee on the its account unless you fulfill a set of conditions, particularly minimal balances standards, and often fees highest charge to own popular banking errors such as for instance decreased money, owing to checks, avoid costs, etc.

Customer service

With a mission concerned about help the members, borrowing from the bank unions almost always keeps a bonus with respect to service and you may support. Once you phone call a cards commitment, you will communicate with someone who lives and you can performs on your community, as opposed to an area otherwise overseas call centre one old-fashioned financial institutions may have fun with, to allow them to most useful learn your specific need.

Common Availableness

Really credit unions was hyper-local, if you move out from county, otherwise take a trip from your own town, you can beat the capability to directly head to a branch of the credit commitment. Bigger banks usually have twigs and you will ATMs located in most major locations. However,, most borrowing unions be involved in a network out-of surcharge-free ATMs, as many as 50,000+ and growing, together with mutual branching capabilities. Mutual branching lets borrowing connection people the ability to visit a special borrowing partnership from the circle so you’re able to procedure financial transactions. In addition to, to the extension from digital financial and adoption of technology by really borrowing unions, banking having a credit union can be done regardless of where your home is, flow or travel.

Selecting the most appropriate Banking Companion

Typically borrowing from the bank unions lacked a number of the mobile and technology features the standard banking companies offered. Although not, which is not the outcome. Really Credit Unions possess the full room regarding on the internet and cellular banking products and services, as well as virtual membership opening, and much more, like their financial competitors. Thus do not let worries out of hassle end you, most borrowing unions are easy to supply.

Leave a Reply