A lot of people don’t have thousands of cash during the bucks sleeping to purchase a property, so they pull out fund called mortgage loans buying a house.

While an initial-day homebuyer or you’re looking for a home loan that may most readily useful see debt means, read on.

This informative article discusses the basics of exactly what a home loan is actually, tips qualify for you to definitely, the most popular variety of mortgages, also some elementary terms you’ll want to know prior to to find a home and you may experiencing the benefits of homeownership.

What’s home financing?

Within the home loan arrangement, you put up the home because collateral, definition the bank may take our home if not build their mortgage payments.

Mortgage loans generally speaking want a down payment-a share of your purchase price the debtor need promote on the desk inside cash before mortgage is created.

If you are searching having a loan provider to try to get a installment loans in Modesto California loan, you ought to glance at the book getting homeowners into the looking a lending company .

Earnings

Lenders want to see you have a history of steady and you can sufficient earnings to build your decided-on mortgage payments each month.

Lenders will look at your private taxation statements, business tax returns, profit and loss comments, team licenses, harmony sheets, plus.

Credit history

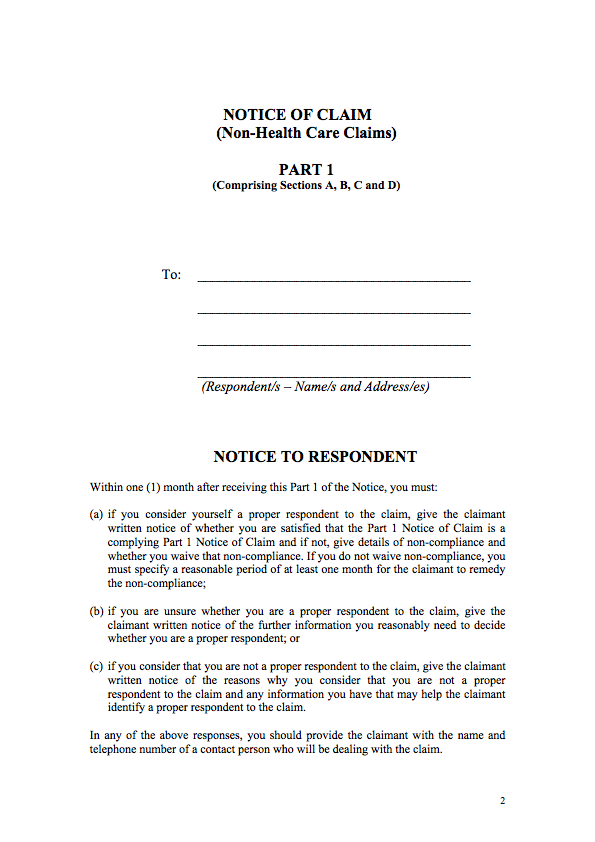

![]()

Your credit score reflects exactly how much loans you really have and just how a youre at controlling they, very of course, a business looking at lending you thousands of dollars has an interest on your own get.

A reduced credit rating indicators greater risk for the bank, this usually means that increased rate of interest in your loan.

People having results a lot more than 700 see lower interest rates and will select qualifying to own home financing convenient than those which have lower fico scores.

Debt-To-Earnings Ratio

Debt-to-money [DTI] ratio takes the complete of your month-to-month loans repayments (student education loans, handmade cards, auto notes, etcetera.) and you can splits they against the terrible monthly earnings.

Loan providers consider this to be proportion to inform if or not you already pulled with the continuously personal debt or if you have the data transfer to handle a home loan commission.

Sorts of Mortgage loans

Rate of interest, size, and you may being qualified standards are very different for every version of mortgage, very talk with the bank to see which method of caters to your own condition better.

Old-fashioned Mortgage loans

Referred to as a timeless financial, a normal mortgage try a binding agreement between both you and the financial institution in fact it is maybe not covered by the regulators.

Because of this, lenders want more substantial advance payment than just bodies-backed loans to ensure that you has actually something you should reduce when the you end and also make the mortgage repayments.

Really old-fashioned mortgage loans meet with the advice to the advance payment and you will money lay out of the Government Homes Fund Administration, even when it support far more liberty toward terms and conditions, interest rates, and possessions brands than many other mortgage loans would.

Benefits regarding Traditional Mortgages

- Far more programs. Traditional mortgages can be used for a primary quarters as well just like the a second household or money spent.

- Finest PMI plan. For individuals who put lower than a 20% down-payment, PMI to the conventional money is 0.5 1% of amount borrowed annually. FHA financing require an upfront home loan insurance policies commission, including monthly obligations.

- A great deal more easy assessment standards. That have authorities-backed mortgage loans, land need certainly to see tight house assessment assistance. Antique loans avoid this type of criteria.

- Flexible terms. Traditional mortgages is created to own terms of ten, fifteen, 20, or 3 decades.

Downsides from Old-fashioned Mortgage loans

- Higher credit rating specifications. Loan providers usually wanted an effective 620 credit history to have old-fashioned loans, even in the event they can boost one to minimum. An informed interest levels head to consumers having ratings significantly more than 740.

Leave a Reply