Per cheque was dated getting encashment to have a specific time. Banking companies dollars new cheques so they really have the EMI fee promptly. It is essential to make certain the bank account regarding and that currency could be debited to pay for financial EMI need sufficient financing for debit to take place. In case the cheque bounces or perhaps the auto-debit cannot experience, you will find a put-off from inside the fee which in turn leads to punishment fees.

The expanded the loan tenure, the reduced the latest EMI and you will the other way around. Utilize the mortgage EMI calculator to get the EMI in order to be distributed a variety of financing tenures. You can find around three enter in areas regarding EMI calculator dominant matter, financing period and rate of interest. The latest calculator have a tendency to calculate the newest EMI matter in numerous credit scenarios in accordance with the type in offered. Brand new applicant may learn the EMI count to own various other loan tenures in one principal count. Such as, when you yourself have input new tenure to be five years very first, you could potentially transform it in order to 10, fifteen and you may twenty years. Your house loan applicant can also be ount he/she’s capable spend conveniently day-on-times. The newest candidate can choose best financing period next take action into mortgage EMI calculator.

Gain an understanding of the home loan EMI prior to getting a beneficial financial

- Formulate a month-to-month budget

Record monthly expenses in the place of month-to-month incomes. One should manage to cut any amount of cash after accounting for typical monthly expenses. Thorough analysis of all the present expenses will show you certain expenditures you to definitely you are able to do away with. Even a small amount of money that’s conserved week-on-week turns out to be a big amount of cash within the termination of the season.

Gain an insight into our home mortgage EMI prior to getting an excellent home loan

- Assess newest cash

Unless of course the home mortgage applicant is aware of his/this lady current financial climate, this isn’t you can easily to alter they. Recording the costs is a great starting point the latest assessment out of profit. Include all expenses regardless of what shallow they might see. All Rupee counts with respect to controlling money. The theory is to try to make certain the costs are at a minimum and there’s a discount finance.

Get an understanding of your house loan EMI prior to getting good financial

- Score an insurance coverage

Health insurance and term life insurance will be most significant insurance rates talks about that a single need. Other than which, people house which is off extreme really worth and that could cost large sums while in repair shall be insured. For instance, homeowners insurance and you will auto insurance policies. Having assets insured gives a comfort when you to understands you to their/this lady lead financial responsibility is restricted.

Gain an understanding of our home mortgage EMI prior to getting a great financial

- Carry out a crisis financing

Having a crisis fund to-fall back to your aids in preventing obligations. Having an emergency financing decrease an individual’s accountability to obtain off financial institutions and you may NBFCs for this reason cutting dependency toward borrowing. And additionally, which have a crisis loans brings inside it the brand new reassurance of being in a position to carry out difficult circumstances without worrying in regards to the economic element.

You should always choose an amount borrowed that covers the expenses involved. Choose for high amount borrowed as long as its absolutely necessary so there are no factors throughout the payment. The reduced the main borrowed, the low will be the EMIs.

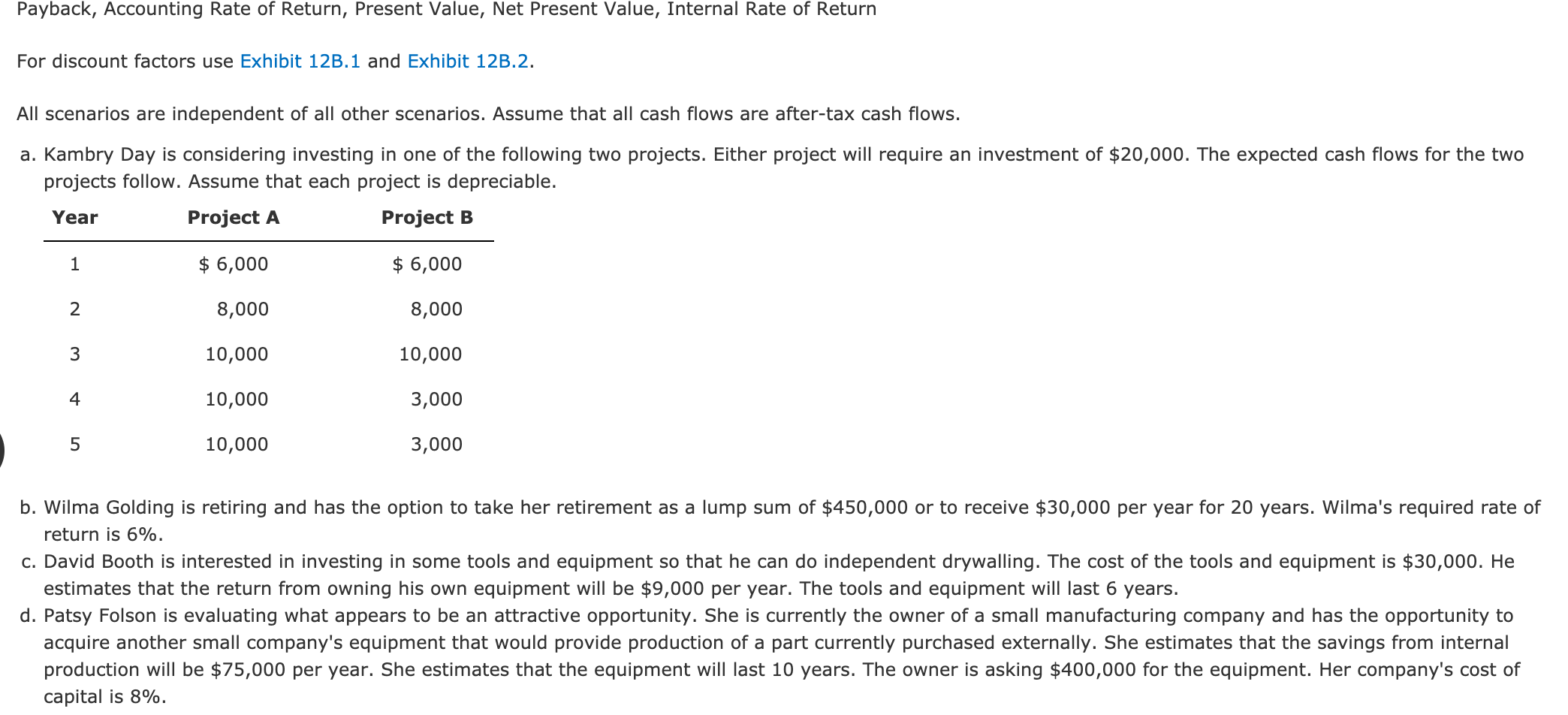

Reference the dining table lower than to locate an insight into EMIs a variety of principal numbers and you will loan tenures. This can be helpful in ount and you can loan tenure that you can pick according to research by the EMIs.

Leave a Reply