Do you want exploring the possibility of paying down your own financial early? We have wishing a collection of solutions to help you pay back your property financing less.

Why should you pay back your home mortgage shorter?

Buying a home is a huge milestone, nevertheless the a lot of time-title union regarding financing is challenging. You could potentially possibly get rid of years’ property value obligations if you are paying actually some extra into the month-to-month bond – out-of big date one or as fast as possible. Some of the specific advantages to settling your residence financing more quickly tend to be:

a. Rescuing on focus

Leading to the minimum mortgage payment means you save significantly towards notice payments. Such, if you have an R1,five hundred,000 thread more 20 years, during the best financing rates away from %, repaying the loan in just fifteen years could save you on R684, from inside the focus will set you back*. This cash can be brought into after that expenditures or toward improving your total economic protection for the later years.

b. Freeing oneself off personal debt

Imagine the reassurance that comes with are bond-free. Plus effectively spending smaller desire, paying off your property mortgage ahead will give you far more financial liberty. Without the load of your house mortgage, you can make use of the fresh new freed-up money to many other investments, advancing years offers or personal welfare (such after that business dream of opening your own Re also/Max Place of work, perhaps?).

c. Boosting your collateral

For those who have an access bond, settling your house loan easily happens hand-in-give that have building your own security from the assets and you will building the financial position. That it improved security is a valuable asset that can give an excellent good base having coming potential, including renovations, otherwise a lowered-appeal replacement car loan.

Tips for paying off your house loans in Laurel Hill loan smaller

Stating good-bye in order to obligations and having financial independence is a lot easier when you really have simple methods as possible take right now. No matter if each one of these procedures can get you closer to becoming capable say goodbye to your property mortgage before plan, always request financial experts in order to tailor this type of suggestions to your specific products:

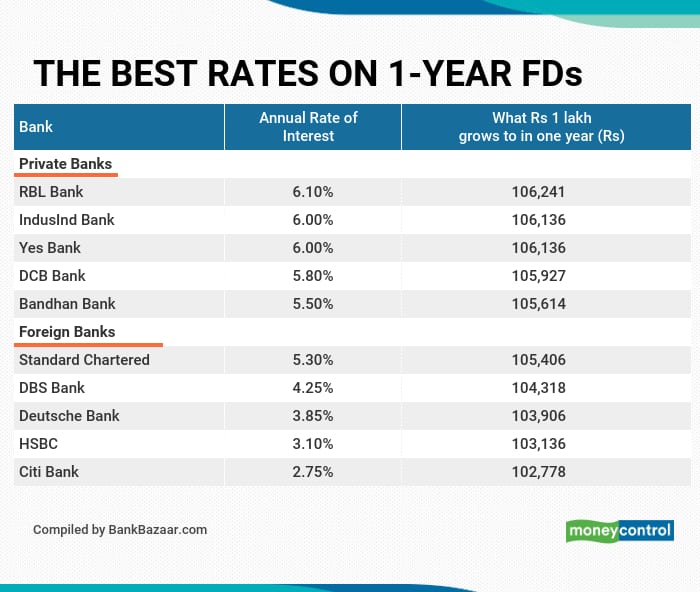

Contain the best interest price Begin your house-purchasing travel from the protecting the absolute most favourable interest rate right at the start. Look and you may examine lenders’ costs to ensure that you obtain the finest bargain in your financial, which can help you towards the very early payment. Having fun with a bond creator for example BetterBond seems to aid members have the greatest package on the mortgage. They score rates from all of the significant banking companies on your own account, helping you save money and time.

Lifestyle redesign Carefully test your spending habits to spot locations to cut back. Research cautiously at the discretionary spending: eating out, amusement subscriptions, and you can response shopping. Through smart choices and you will prioritising your financial requires, you could reroute the individuals deals toward thread payment and relieve your property loan.

Turn your rubbish into the someone else’s value Embrace the interior conservative and you can declutter to totally free your house out-of too many items that is actually get together soil. Don’t put all of them out, instead talk about on the web opportunities and you can/or promote them via regional thrift teams to convert your own previous treasures toward bucks that one may increase their bond repayment.

The nothing additional facilitate Every small, even more contribution is important. Whenever you can, inject their monthly costs having a supplementary dosage of dedication – no matter if everything you are able to afford try a supplementary R50 which times. Such most number help to incrementally processor chip aside on dominant obligations, reducing the name in your home loan and helping you to save very well interest charge.

Leave a Reply