The new FHA financing ‘s the earliest and most better-understood low down payment home loan getting first-date home buyers. It will be the catch-all the selection for people who don’t see other lower with no down-payment financial conditions.

- An advance payment dependence on step 3.5 percent

- All the fico scores acknowledged and you may invited

- Mortgage products in the FHA’s insurance plan restrictions

Also, FHA financing was assumable, meaning that when a buyer sells their home, the fresh manager can use an equivalent FHA home loan on same financial rate of interest.

From the FHA, U.S. homes normalized by later-1930s. 9 age later on, the new FHA’s leading mortgage has assisted 10s out of countless Us americans buy its first family. Almost one in 5 very first-date consumers play with FHA funding.

- → Short-term Reputation of the newest FHA

- → How can FHA Financing Really works?

- → Just what Credit history How would you like For an FHA Financing?

- → How do you Qualify for an effective FHA Mortgage?

- → Just what are FHA Loan Constraints?

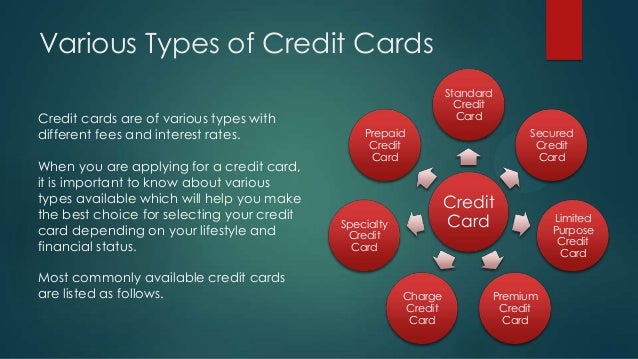

- → Do you know the Different varieties of FHA Fund

Short-term History of the fresh new FHA

Up until the FHA, the only real place for earliest-big date homebuyers to acquire a mortgage are its regional area bank.

As banking companies was indeed scared while making lenders and you will homes was inbuilt on the recuperation, the federal government circulated the latest FHA given that an insurance agencies getting banks. http://paydayloanalabama.com/berlin/ As long as a citizen and its own financial came across brand new government’s given conditions, the new FHA provided to repay the lending company is a citizen standard to the their payments.

With FHA home loan insurance policies available, banks come and also make fund to basic-day consumers once again, and you will property led the nation away from Anxiety.

How do FHA Fund Performs?

FHA-recognized mortgage loans use the same home loan package since most other U.S. lenders. Customers borrow funds, commit to monthly payments, and you will pay-off the loan within assortment of 15 otherwise 3 decades.

There is absolutely no penalty getting promoting your house before the mortgage gets repaid, and you will, given that homeowner, people maintain the to shell out its loan off smaller otherwise re-finance they.

FHA financing need you to consumers make a down payment regarding in the the very least step 3.5 % up against the purchase price, or $step 3,five hundred each $a hundred,100000. There is no restriction deposit number.

Considering mortgage app business Freeze, the common FHA house client can make a down payment from quicker than just 5 %.

Exactly what Credit score Would you like To own a keen FHA Financing?

FHA loans require really customers enjoys a credit score out-of 580 or higher, but individuals with scores as low as five-hundred qualify having a deposit out-of 10 percent or maybe more.

How do you Be eligible for an effective FHA Financing?

So you can be eligible for a keen FHA financial, home buyers additionally the domestic they purchase need to meet the FHA’s qualifications standards, described right here:

The latest FHA will not demand the very least credit rating because of its mortgage system and you can helps make unique specifications for customers no credit score or credit score. This new FHA sends loan providers to seem beyond somebody’s credit score and find brand new problem. Discover more about the financing rating wanted to get a home.

There aren’t any unique eligibility criteria for the FHA mortgage program. Home buyers can live in people property in just about any U.S. urban area.

Customers do not require personal protection quantity, often. Non-long lasting resident aliens may use FHA mortgage loans, as well as personnel around the world Financial and you may foreign embassies.

FHA home loan guidance is faster tight than many other authorities-recognized home loan applications. If you have obtained turned-down to own a normal mortgage otherwise Va loan, FHA investment could help stop renting and start owning.

What exactly are FHA Mortgage Restrictions?

The fresh FHA simply makes sure mortgage loans from certain products. Its top limitations are different by region. The newest constraints can be known as the FHA loan constraints. The new Federal Houses Funds Agencies (FHFA) condition loan constraints a year.

New FHA provides that loan restrict table which can be used to check on the utmost deductible loan size on your state.

All over the country, this new 2022 FHA loan restriction are $420,680. Inside the places that the price of life style is higher than typical particularly Bay area or Brooklyn FHA financing limits is actually elevated so you’re able to of up to $970,800.

Leave a Reply