Cash out refinance

A cash-out refinance is a kind of financial which enables you to definitely re-finance your existing financial and take aside a lump sum of cash from your own offered household guarantee. This is certainly recommended if you have security created right up in your home and would like to put it to use to finance the renovation project whilst refinancing your current home loan having a good all the way down interest rate or additional label duration.

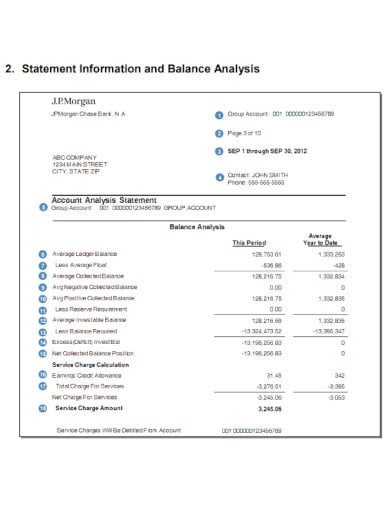

Signature loans

If you don’t have far security of your house, an unsecured loan is recommended for a major do-it-yourself. This type https://cashadvancecompass.com/payday-loans-co/new-castle/ of typically have highest interest levels than simply finance that will be secure of the security. However, because they do not want collateral eg property equity financing really does, you won’t end up being prone to dropping your house.

Benefits

- Help the worth of your house: Renovations could raise the property value your home, which can be beneficial for strengthening equity or probably raising their revenue price.

- Cover the deals: If you opt to sign up for a loan to finance your own do-it-yourself enterprise, you will never need withdraw money from the savings to cover the expense. When taking aside financing, be sure to will pay they straight back, level at the very least minimal monthly payment so long as you have it.

- Get paid beforehand: A home loan loan offers usage of currency up front, without having to wait and build right up discounts for adequate cash to afford all your valuable recovery endeavor. That is especially of good use if you wish to make immediate fixes.

Cons

- Attract and you may fees: One of the primary drawbacks from resource your residence recovery try the attention and costs of the borrowing funds from a loan provider. According to the capital solution you select, you are able to run into higher attract charges that may add up over big date.

- Basic also offers: Particular playing cards may offer basic also offers with a good 0% Annual percentage rate to possess a-flat months. If you find yourself these could feel a good way to borrow funds to possess a temporary, if you don’t repay the balance within the 0% Annual percentage rate months, you are billed highest attention and charges.

- Chance to your residence: With protected acquire possibilities such as for instance a house security loan, HELOC, otherwise cash-out re-finance, you are utilizing your home since equity. Because of this if you are incapable of build payments, you might risk dropping your property.

Information charges and you will costs

Just like the remodeling your residence is going to be a vibrant feel and in addition an expensive one, it is possible to become familiar with the possibility charges and you can can cost you that will normally become from the home improvement financing.

- Fees: When taking aside that loan to invest in a repair, you will be energized fees. These types of costs range from app charges, origination charge, appraisal charge, and you may closing costs, with regards to the version of investment plus lender’s standards. Specific lenders can offer to fund this type of costs for their customers, thus would search into the possibilities that are offered to you before applying for a financial loan. You might find that a loan that have increased interest rate but all the way down overall fees works for your budget believed. Or, you might find that having fun with a combination of financial support choice gives the finest total offer. Whatever you decide to go with, the choice always depends on just what matches your unique demands and you can expectations.

- Costs: As well as charge, you ought to be aware of overall enterprise costs, plus labor, content, permits, and people unforeseen costs that could potentially occur in procedure. Keeping track, generate a list of everything you envision you’ll need for a beneficial endeavor and you can research the expenses associated with for each goods, including work and you will permits. Then, intend to plan for a backup fund that will protection unexpected expenditures. This should help you to set up the shocks that will develop when you start to remodel.

Leave a Reply