Consumers throughout these says gets the most significant display from Chairman Joe Biden’s money-determined payment relief

Many People in the us said they need to impede major lifetime goals since the of its student education loans, however in specific claims, to acquire a house could help pay off the debt.

When you’re student loans usually are a shield to household entryway for the specific claims, in others they could assist individuals qualify for certain family-to invest in guidance software and simplicity your debt load, the newest declaration towards Hill told you. Certain states, looking to attract the fresh customers, bring to pay off college loans in exchange for swinging there. Several other claims keeps student debt settlement but wanted consumers to have a degree into the dental, medicine, nursing, or legislation.

Kansas

Kansas will pay around $15,000 for everyone which have a college degree to apply so long because they are new to the area. Consumers just who move into among ninety counties appointed just like the “Rural Chance Areas” can be discovered student loan payment guidelines and/otherwise 100% state taxation credit, with regards to the Ohio Place of work off Outlying Prosperity.

Maine

The fresh new Maine Money Authority’s student debt settlement program will pay $dos,500 in refundable tax credit value a-year or $25,000 existence worth to have costs produced in your student loans. To qualify, you need to have received your own degree (member, bachelor, or scholar) just after 2007 out-of one licensed college or university worldwide and also started a beneficial Maine citizen in taxation season which had a keen attained earnings from $11,934 or more.

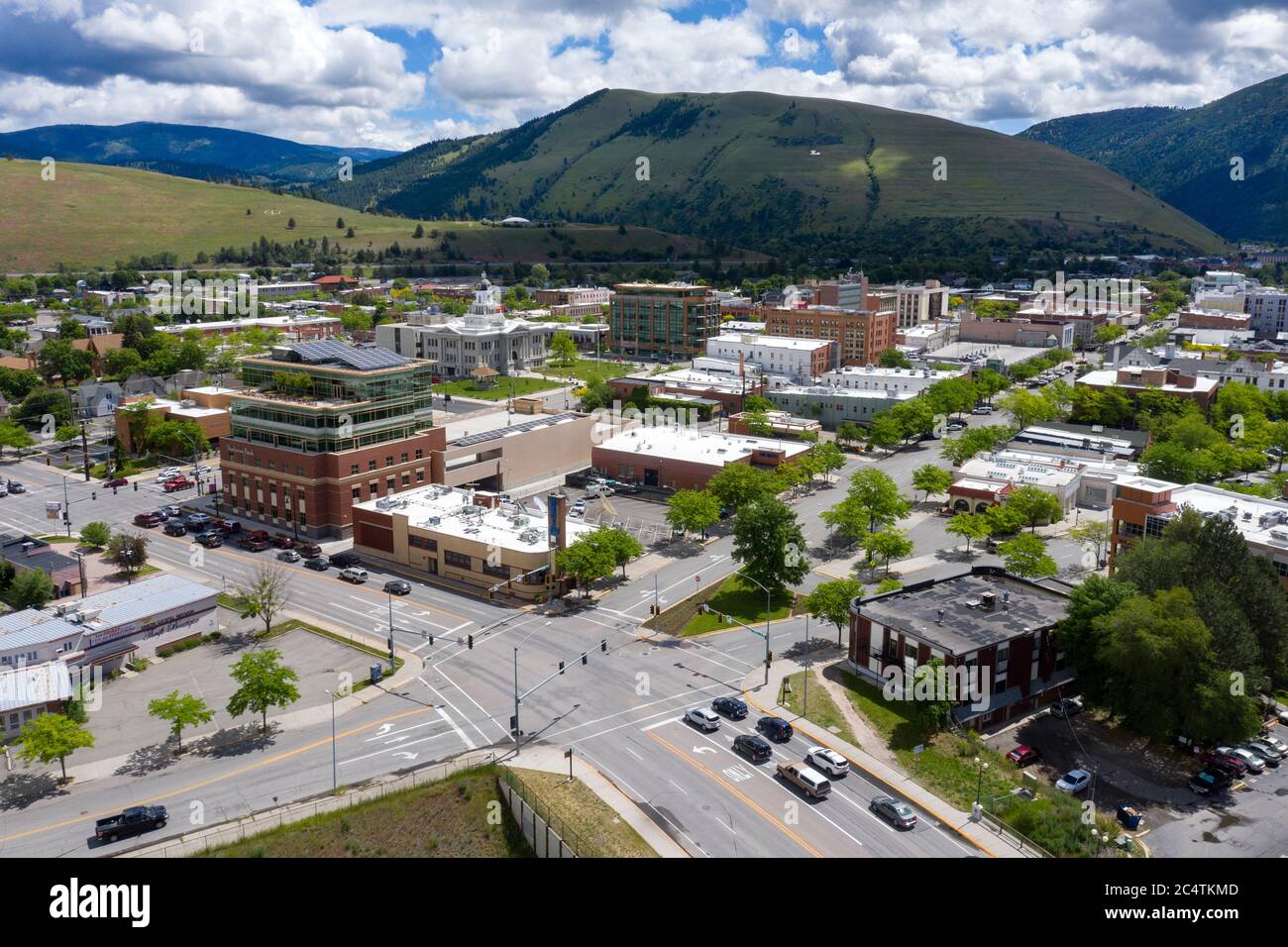

Maryland

also provides education loan borrower fees direction. The applying has the benefit of qualified users a total of $forty,000 or around 15% towards the to get property. Consumers have to have a $step 1,000 the least education loan debt, keeps a college education, enjoys a max home money out of $92,five hundred otherwise $154,420, and really should get a property of a medication financial.

If you are ready to research rates to own a mortgage, you need to use the Reputable marketplaces so you’re able to effortlessly examine interest rates of numerous mortgage lenders and then have prequalified in minutes.

Children way of life right here score a bigger share from student loan rescue

Chairman Joe Biden’s plan to forgive as much as $10,000 inside the federal fund for each and every borrower while making less than $125,000 a year (lovers and come up with lower than $250,000) and up in order to $20,000 for each and every borrower in the event you made use of Pell Grants inside university, eliminating on $441 mil within the outstanding student obligations, is actually struck off by the U.S. Best Court this past seasons.

About aftermath with the decision, the fresh Agencies away from Degree launched change to help you their income-driven installment (IDR) preparations which will collectively forgive as much as $39 billion within the federal student loan obligations.

In Saving into the an invaluable Degree (SAVE) package, individuals could see monthly obligations lower to help you zero bucks, month-to-month costs cut in half and those who generate costs could conserve at the least $step 1,000 per year, the latest Light Household said for the an announcement.

The program computes brand new payment per month number centered on a beneficial borrower’s money and you will loved ones proportions, with respect to the Institution from Education. This means that for those making $thirty-two,800 a year otherwise reduced, and this usually means around $fifteen an hour, the monthly payment manage drop so you’re able to $0 quickly.

Georgia, Maryland and you may Louisiana are required to have the high mediocre federal beginner financial obligation forgiveness for borrowers, which have an estimated mediocre greater than $54,000 forgiven for each debtor, according to directory, according to a recently available Scholaroo list.

These represent the top ten says that score a more impressive cut out of Biden’s $39 mil education loan forgiveness cake each borrower, based on Scholaroo:

- Georgia $55,206

- Maryland $54,824

- Louisiana $54,292

- Utah $53,807

- Tx $53,658

- The state $53,373

- Florida $53,343

- Alaska $52,990

- Sc $52,370

- Tennessee $51,143

Consumers that have individual figuratively speaking wouldn’t qualify for federal mortgage forgiveness but can ease its load by refinancing to reduce its monthly costs. An online unit for example Credible makes it possible to evaluate student loan refinancing cost before applying to greatly help get the best package to you personally.

Student loan money could possibly get force some to build up loans

Immediately after student loan payments resume, specific consumers (28%) are concerned your extra worry on their month-to-month budgets you’ll force these to take on way more financial obligation, centered on a recent questionnaire of the Reach.

Within the 41-times student loan payment stop, 45% off participants told you it paid other obligations. Yet not, 65% obtained the fresh debt during this schedule out-of credit card debt and you may car loans to help you unforeseen medical costs, the fresh new survey told you. Whenever requested how the end of forbearance program commonly apply to their earnings, 61% believe it will receive a life threatening otherwise reasonable negative effect.

“Immediately after more than 3 years, of numerous people are today bracing for extreme alterations on their home spending plans,” Go Cofounder and you will Co-Ceo Andrew Housser said. “Of many may also have to decrease significant existence agreements and you may milestones to help you carry out the figuratively speaking, established costs and other big date-to-day expenses.”

If you’re having problems and also make money on the private student education loans, you’ll not installment loans in New Brunswick make use of such state programs as they are tailored with the government student loan recovery. You could thought refinancing the funds to own a lesser rate of interest to lessen your own monthly payments. Check out Legitimate to get your personalized price within a few minutes.

Leave a Reply