To shop for a property is just one of the greatest assets balboa capital high risk loans you might make, and as the worth of your house develops, you can make use of you to definitely growing wealth without having to offer brand new house.

But what type is right for you? In this article, i discuss those two points, the way they performs, and conditions in which you can getting a much better options than simply the other.

Reverse Mortgage Axioms

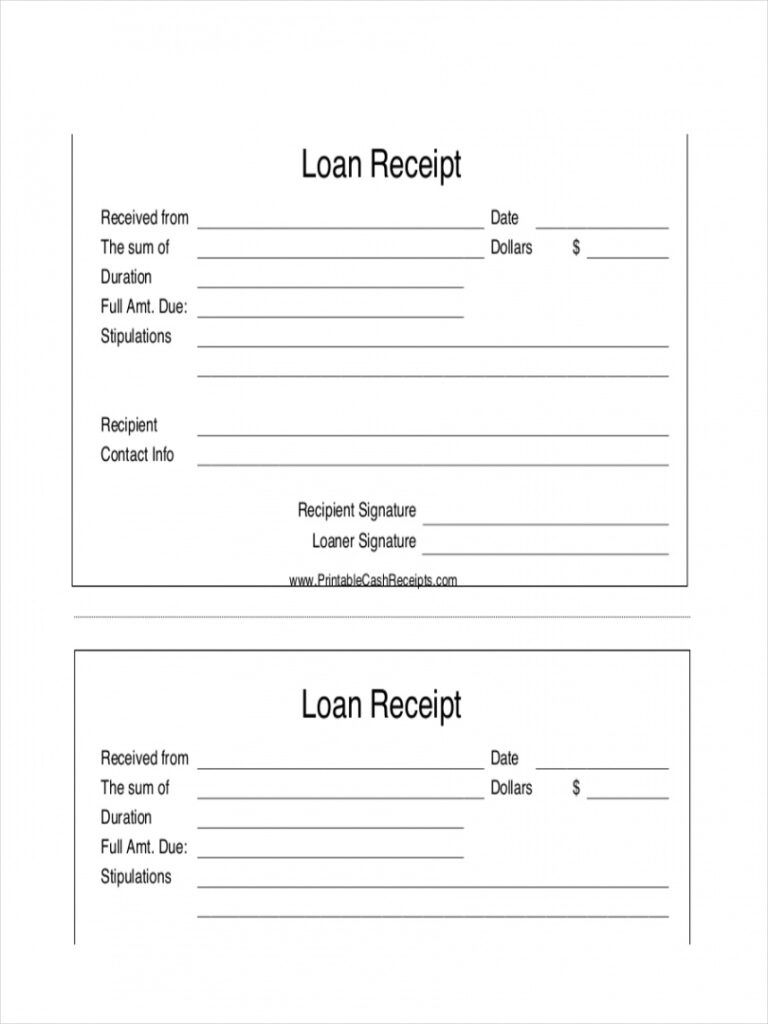

Property Guarantee Transformation Home loan (HECM), called a reverse home loan, is that loan option designed to help home owners convert their home equity towards bucks. When you take out good HECM reverse mortgage, the current home loan might possibly be paid entirely, you no more need to make regular monthly premiums towards the their completely new mortgage.

A contrary mortgage allows property owners to alter the rest mortgage harmony towards the bucks. The income would be obtained in a variety of ways, such as a lump sum payment, equivalent monthly payments, or a face-to-face home loan personal line of credit. As an alternative, you might go for a mixture of these alternatives.

A contrary mortgage try paid off if home is marketed, if the house is no further put because number 1 quarters of the resident, otherwise when the past citizen dies.

Contrary Mortgage Standards

- People should be at least 62 yrs . old or elderly

- The home must be the primary house. Consequently a reverse financial cannot be obtained getting a great secondary assets instance a vacation domestic or investment property.

- The home should have extreme guarantee

- The house or property needs to be when you look at the good condition

Just before property owners can be commercially make an application for a contrary financial, they need to very first over a sessions training which have a prescription therapist in the U.S. Agency out of Houses and you will Urban Development (HUD). So it guidance session helps to ensure that home owners discover most of the threats and you may benefits a part of an opposing mortgage and will create an educated decision.

Following the opposite mortgage loan closes and you start finding your money, contrary home loan consumers need certainly to still take care of the household, afford the requisite assets taxation, home insurance, and every other necessary charges, such as for instance HOA costs.

Reasons to Prefer an other Mortgage

As opposed to most other financial products, there is not one means to fix discover money from a opposite home loan. Alternatively, individuals choices are offered, particularly a lump sum payment, monthly installments, otherwise a beneficial HECM personal line of credit. These choices normally joint to raised fulfill your unique demands.

There are also no laws exactly how reverse home loan proceeds provides to be used. not, here are a few preferred means a reverse financial is utilized:

- On the Advancing years Profile. When you’re approaching otherwise currently inside later years and you can do not have the required offers to keep the wished lifestyle but affect individual your own family, an other mortgage may be worth provided inside your advancing years profile.

- Unplanned Costs. Without having enough money for emergency expenditures, you can even imagine taking out an opposing financial and receiving the newest continues while the a line of credit. This can ensure that your funds are available will be an urgent bills arise.

- Enhance a predetermined Earnings. When you are way of living towards a fixed money, following a reverse mortgage provide most monthly money. With a face-to-face mortgage loan, there is the option of choosing to have the loans inside the form of monthly installments, which can help pay the bills.

- Change your Household. If you don’t have brand new deals to cover will set you back of significant home improvements to your house for the old age, an opposing home loan may help you make certain they are. Additionally, these types of enhancements can potentially enhance the worth of your property. Getting a lump sum of a contrary home loan you will give much-needed financial assistance to have such ideas.

Leave a Reply