If the company prepares a balance sheet prior to distributing the stock dividend, the Common Stock Dividend Distributable account is reported in the equity section of the balance sheet beneath the Common Stock account. Note that dividends are distributed or paid only to shares of stock that are outstanding. Treasury shares are not outstanding, so no dividends are declared or distributed for these shares.

Get in Touch With a Financial Advisor

The dividend payout ratio, which measures the proportion of earnings distributed as dividends, provides insights into the company’s earnings retention and distribution strategy. A high payout ratio might suggest limited reinvestment in growth opportunities, while a low ratio could indicate a focus on internal growth. Similarly, ROE, which measures the return generated on shareholders’ equity, can be affected by dividend payments.

Capitalization of Retained Earnings to Paid-Up Capital

However, the statement of cash flows will not show the $250,000 dividend as it has not been paid yet; hence no cash is involved here yet. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. There are two types of stock dividends—small stock dividends and large stock dividends. The key difference is that small dividends are recorded at market value and large dividends are recorded at the stated or par value.

Journal Entries for Withholding Tax

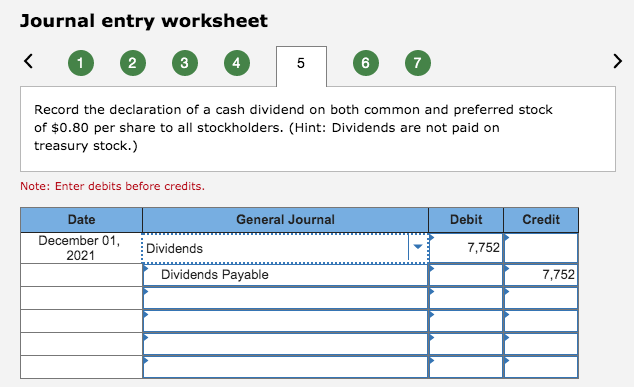

Declaration date is the date that the board of directors declares the dividend to be paid to shareholders. It is the date that the company commits to the legal obligation of paying dividend. Hence, the company needs to make a proper journal entry for the declared dividend on this date.

Impacts to your financial statements

The company makes journal entry on this date to eliminate the dividend payable and reduce the cash in the amount of dividends declared. Hence, the company needs to account for dividends by making journal entries properly, especially when the declaration date and the payment date are in the different accounting periods. A stock split is much like a large stock dividend in that both are large enough to cause a change in the market price of the stock. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. This is the date that dividend payments are prepared and sent to shareholders who owned stock on the date of record. The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit).

The date of record is when the business identifies the shareholders to be paid. There is nothing wrong with this procedure, except that a closing entry must be made to close the Dividends Declared account into Retained Earnings. As a result of this entry, the ultimate effect is to reduce retained earnings by the amount of the dividend. Returning to the General Electric Company example, the company paid dividends of $852 million in 1983, which represented 42% of its net income. From a theoretical and practical point of view, there must be a positive balance in retained earnings in order to issue a dividend. On the payment date, the following journal will be entered to record the payment to shareholders.

- At the date the board of directors declares dividends, the company can make journal entry by debiting dividends declared account and crediting dividends payable account.

- This credit is designed to account for the corporate taxes already paid on the distributed profits, thereby reducing the overall tax burden on shareholders.

- A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation’s own stock.

- While a company technically has no control over its common stock price, a stock’s market value is often affected by a stock split.

- The amount credited to the Dividends Payable account represents the company’s obligation to pay the dividend to shareholders.

- On the dividend payment date, the cash is paid out to shareholders to settle the liability to them, and the dividends payable account balance returns to zero.

There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. For corporations, there are several reasons to consider sharing some of their earnings with investors in the form of dividends. Many investors view a dividend payment as a sign of a company’s financial health and are more likely to purchase its stock.

On the other hand, stock dividends distribute additional shares of stock, and because stock is part of equity and not an asset, stock dividends do not become liabilities when declared. When a cash dividend is declared by the board of directors, debit the retained earnings account and credit the dividends payable account, thereby reducing equity and increasing liabilities. Thus, there is an immediate decline in the equity section of the balance sheet as soon as the board of directors declares a dividend, even though no cash has yet been paid out.

The major factor to pay the dividend may be sufficient earnings; however, the company needs cash to pay the dividend. Although it is possible to borrow cash to pay the dividend to shareholders, boards of directors probably never want to do that. However, the principle is the same, you are just able to skip the temporary dividends payable portions of the entry. The end result across both entries will be an overall reduction in retained earnings and cash for the amount of the dividend.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Amy is a Certified Public Accountant (CPA), having worked in the accounting industry for 14 years. She is a seasoned finance executive having held various positions both in public accounting and most recently as the Chief Financial Officer of a large manufacturing company based out of Michigan. The reduced cost per share will increase the gain or decrease the loss on subsequent sales of the stock. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

After your date or record, your liabilities will increase and your retained earnings will decrease. Then after the payment, both your cash account and your liability will be reduced. Don’t worry, your balance sheet will still balance since there will be offsetting changes. As you would expect, dividends shouldn’t should you and your spouse file taxes jointly or separately impact the operating activities of your company. That means declaring, paying, and recording dividends won’t change anything on your income statement or profit and loss statement. Furthermore, as is evident from the statement in the General Electric Company annual report, a firm has other uses for its cash.

Leave a Reply