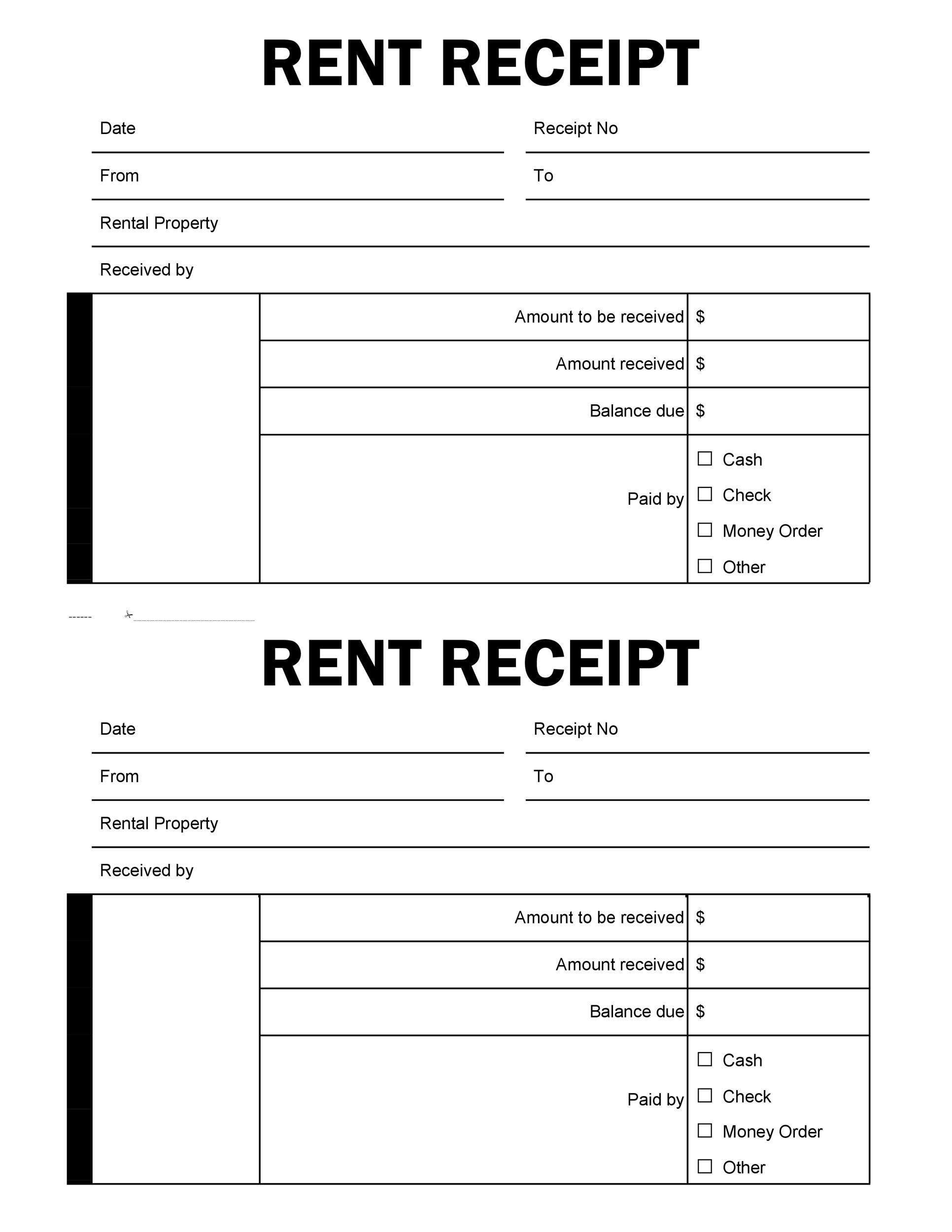

Lenders should find some records in the application for the loan procedure. You will need to inform you the lending company evidence of identities, for example an authorities-issued ID, including a driver’s license, passport, or condition ID cards.

you will need to render certain proof money, such as your most recent pay stubs or tax returns. While self-functioning, you may need proof your a position record, eg 1099 variations or lender statements.

The newest FHA will not provide money straight to consumers. Instead, they work having recognized lenders who can render FHA-insured fund.

Many types of FHA-approved lenders exist, in addition to banking institutions, borrowing unions, and you can mortgage enterprises. Look around to obtain the lender that gives an educated terms for the www.clickcashadvance.com/installment-loans-il/phoenix/ sorts of condition.

3 – Score Pre-Accepted

Home financing pre-acceptance was a beneficial conditional relationship off a lender. It’s not a guarantee that you’ll receive a loan, however it does reveal that the lender was willing to works to you. Bringing pre-approved might help improve the house-to buy techniques while making moving on that have an FHA 203k loan simpler.

The lender tend to feedback debt suggestions to decide just how much currency he could be happy to provide your. They will certainly along with examine your credit score to see if you fulfill their minimum standards.

Step four – Pick property

Now you must to begin with seeking a property. Keep in mind that having an FHA 203k financing, you can buy a beneficial fixer-top otherwise a foreclosures. It is a powerful way to get more property to own your money.

Imagine if you have difficulties wanting a property? You may envision coping with a representative focusing on FHA 203k fund. They are familiar with the procedure that can have the ability to support you in finding property that fits your circumstances.

Step 5 – Create an offer with the Property

Once your family bing search is finished, and you may you discover a home you love, it is the right time to build an offer. According to the supplier, it may take a little while until the offer is actually acknowledged. While dealing with a representative, they have to be useful, negotiating the house rate and you will package conditions so you’re able to secure the deal rapidly.

Don’t forget to include a backup with the FHA mortgage recognition on your offer. This may cover you whether your FHA loan falls using. you will must plan a property check so that the property is for the great condition.

Action six – Score an assessment

One of several requirements regarding an enthusiastic FHA 203k loan is the fact an FHA-approved appraiser appraises the property. New assessment will assist the lender regulate how much currency in order to lend both you and whether or not the possessions suits FHA recommendations.

The brand new appraiser will appear during the property’s reputation and ensure it meets FHA criteria. They will certainly including evaluate they to other services in your community in order to verify it’s valued correctly. The new appraiser tend to notice solutions in the report in the event the fixes you need to be produced.

Action eight – Submit an application for the mortgage

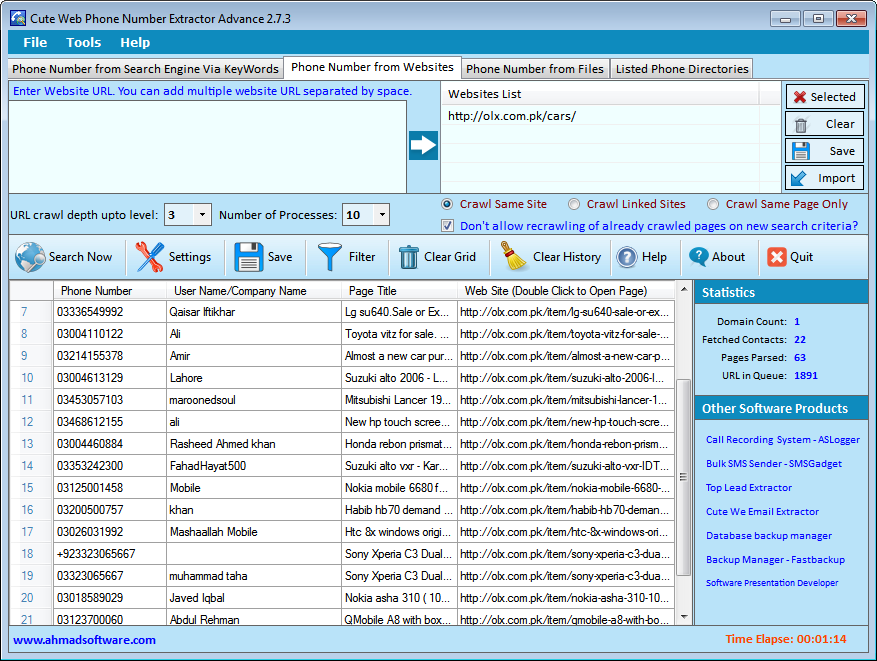

Now it’s time so you’re able to fill in a credit card applicatoin. The lending company often require all your valuable economic recommendations and pointers regarding assets you happen to be purchasing. They will certainly also pull your credit score to evaluate your credit rating and you may background.

Once you’ve filed the loan software, new FHA will send an enthusiastic inspector to ensure the property matches their recommendations. They’ll question financing union letter in the event the things are doing par. That it formal file claims how much money you will be accepted so you can obtain.

Action 8 – Close on your Loan

The very last step should be to romantic on your FHA 203k loan. This is when you can easily signal all the files and theoretically end up being a citizen. You will also need to make a downpayment immediately.

Leave a Reply