Georgia FHA Funds Standards and you can Financing Limitations having 2022 Georgia FHA Lenders

Georgia home buyers who require a small advance payment otherwise have bad credit scores may be able to purchase a home that have a keen Georgia FHA loan. There are numerous FHA lenders into the Georgia exactly who render FHA money, yet not them take part in most of the FHA loan solutions.

We’re going to take you from the Georgia FHA financing criteria, detail what is needed so you’re able to qualify, after that help you to get pre-accredited. For people who know you to definitely an FHA loan is useful getting you, following simply click for connecting which have an enthusiastic Georgia FHA bank whether you live-in Atanta, Columbus, Savannah, Sandy Springs, otherwise anywhere else.

The newest deposit conditions to have a keen FHA loan is the same in just about any state. The minimum need for an enthusiastic FHA mortgage was step 3.5% of purchase price. However, if the credit score are lower than 580, then the down-payment requirement could be ten%.

There are various down payment advice apps in virtually any state. Below try a list of but a few deposit advice software that may be available to choose from from inside the Georgia. Homebuyers should get in touch with, and you can arrange for this type of applications by themselves. Lenders will accept money from all of these apps for your down commission nonetheless they cannot policy for the latest advance payment direction.

Georgia FHA Loan Standards to own 2022

They are basic FHA mortgage criteria for it year. All these have to be fulfilled becoming recognized to have an enthusiastic FHA loan. If you aren’t self-confident into if or not your meet these requirements or possess questions, a keen FHA bank will help.

- Downpayment from 3.5% otherwise ten% when your credit score was below 580

- 2-seasons a job records with many exclusions anticipate

- Totally document your income over the past 24 months

- Minimal FICO get element five hundred down payment are very different

- Mortgage Premium (MIP) needs for every single FHA financing

- Maximum debt so you can money proportion of 43% with exclusions as much as 56%

- The house must be your primary quarters

- Zero bankruptcies or foreclosures in past times a couple of years

Georgia FHA Loan Benefits

- Down credit scores permitted

Most useful Georgia FHA lenders

These firms are just several options on the best way to believe. Take note that every bank is different and is you can easily you to definitely none of those options are effectively for you based upon the circumstances.

Let’s assist you to find the best Georgia FHA loan providers close by by doing which FHA mortgage circumstances means having some elementary loan circumstances information. No credit report would-be pulled and now we Washington online installment loans is hook up your with the best choice.

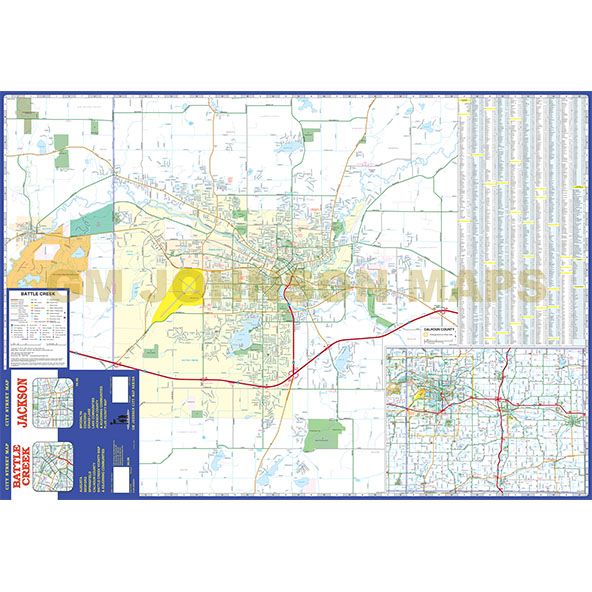

Georgia FHA Loan Limitations

All county in the usa keeps particular restriction mortgage restrictions that are set for unmarried family members house, and two-4 tool features. The fresh restrictions are ready centered the typical family conversion process value in this condition. The beds base FHA loan limit getting unmarried relatives houses inside the Georgia for the majority of counties is $420,680. Use this FHA financing restriction look device to see just what FHA financing constraints have been in the state.

FHA 203k Funds inside the Georgia

FHA 203k fund are a good system which will assist you in order to use the bucks wanted to purchase the domestic and most finance must rehabilitate or renovate the house. This method is additionally available in your state so we performs that have lenders that help together with your FHA 203k loan.

If you would like to completely understand how this method performs, i highly recommend studying our review of FHA 203k money .

FHA Improve Re-finance in Georgia

The new FHA improve re-finance system can be obtained so you can present home owners just who desires re-finance for a lower rate when you’re getting rid of particular of the re-finance costs such as an appraisal. You may want to get a savings towards the home loan cost which is an additional benefit.

Georgia FHA Mortgage Pre-Acceptance Techniques

Speak to a lender early in the process because they can pick possibilities to assistance with your FHA recognition. This should be over months beforehand looking a beneficial domestic. Find out more on how to get pre-acknowledged to own an FHA financing .

What to Look for in an enthusiastic FHA Lender

We get several things into account when examining and therefore loan providers we work at. Some of these along with tends to be, or will likely be important for your as you keep searching getting an enthusiastic FHA financing.

Leave a Reply