Exactly what You will understand

An effective Virtual assistant financing is among the greatest financing applications inside lives, plus it has the benefit of a multitude of benefits to qualified experts. But there are some well-known misunderstandings surrounding the borrowed funds – those types of being entitlement. Most people accept that Va entitlement is a-one-go out work with. But that is not true. Once you’ve made the advantage, you’ll have they all of your current life. To spell it out, entitlement is the dollar amount new Va guarantees to repay this new financial, however if a debtor defaults on the financing. When you rating good Virtual assistant mortgage, really does which means that all of your current entitlement is gone? Not at all times. Could i features several Va financing at one time? The simple address – yes! In some situations, you could potentially own two home at a time which have the next Virtual assistant mortgage, if you have sufficient remaining entitlement. Prior to i dive from inside the, why don’t we get two tips back and explain the financing and you can Virtual assistant entitlement in detail.

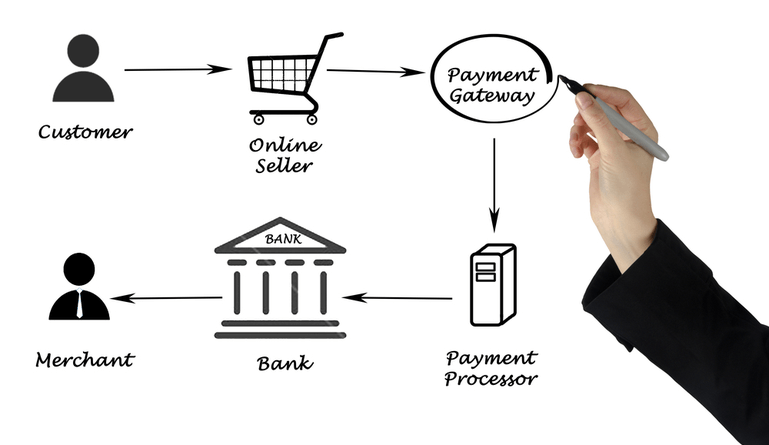

If you wish regarding enabling provider players finance a home that have positive loan terms, an excellent Va Loan was a mortgage loan that’s secured of the U.S. Company off Seasoned Situations (VA). Area of the perks of an effective Virtual assistant mortgage would be the fact no off payment is needed, as there are noprivate mortgage insurance rates). So you can be eligible for a Va loan, you truly need to have a legitimate Certification off Eligibility (COE), and you also need see certain income and credit standards. Period of services, perform, and obligation condition may apply at the qualifications.

You are capable receive a beneficial COE for individuals who fall in to any of your pursuing the categories: experienced, energetic obligations solution representative, Federal Shield affiliate, reserve user, or enduring spouse.

Simply how much entitlement really does the latest Va give?

Entitlement might be confusing for even by far the most educated financial positives. But it surely just relates to a little bit of mathematics. In most areas of the nation, very first entitlement was $thirty six,000. In addition, supplementary entitlement try $70,025. Adding those people to each other will give you all in all, $106,024 to own qualified experts. For the higher cost areas, it may be so much more. Additionally, the latest Va assures a quarter of your loan amount to own fund more than $144,000. Thus, you might proliferate you to entitlement count, $106,024, by the five to possess a maximum loan amount off $424,100. That is the complete count certified people you may obtain prior to being forced to reason for a deposit.

When could i score a moment Virtual assistant mortgage?

Why don’t we recommend you currently a beneficial own property within the Pensacola, Fla., financed which have good Va loan. you only obtained purchases having a long-term changes away from route (PCS) in order to Norfolk, Virtual assistant. Let’s say we need to keep your existing domestic for the Fl and you will book it, plus are interested to buy another house in the Norfolk which have an additional Va loan?

With plenty of leftover entitlement, you happen to be in a position to secure an online loans Selmont West Selmont, AL extra Va loan which have little to no currency down to get a property on the the fresh new town.

Firstly, you simply can’t purchase property with an excellent Va loan into the just intent off leasing it out. However, for individuals who ordered property for the intention of using they as your number one home, and then you lived in it a bit, you will be capable lease it out after. Why don’t we suggest you borrowed from $150,00 for the first domestic. Given that Virtual assistant promises a quarter of your own amount borrowed, it means your fastened $37,five-hundred of your own entitlement. As previously mentioned ahead of, in the most common parts of the country, the complete entitlement is actually $106,025. Simple subtraction tells you that you have $68,525 remaining entitlement you have entry to. And you may once more, proliferate that from the five, along with a maximum of $274,100. Bear in mind, this isn’t the new max amount you could potentially invest in a house. You would just need to cause of a deposit to have anything more which count.

Exactly what are the fine print?

Obtaining a second Va mortgage do have particular criteria. With many loan providers, you really must have a renter closed towards the a lease and you will a cover put so you can counterbalance your first Virtual assistant loan mortgage repayment. And get a renter secured when you look at the facilitate the debt-to-income ratio because it offsets their mortgage repayment, sadly, any extra leasing earnings can’t be used for the being qualified to suit your second loan. For example, say your own monthly homeloan payment try $800, but you will charges the renters $1,000. You to definitely $two hundred most can’t be put just like the additional income to help you qualify for an extra Va financing. Earnings certification getting second properties may vary from the lender, so be sure to ask about the necessary underwriting advice when applying for a moment house. Additionally, you can still need to meet with the occupancy conditions out of an excellent Virtual assistant loan, which means that new family need to be the majority of your house. You will have to invade your family in advance of a specific big date period entry (always 60 days) following the their closure. Va money are perhaps an educated financing system offered. And if you’re qualified, always know how to get complete advantage. If you have questions about preserving your house and buying once more, feel free to get hold of home financing banker.

Leave a Reply