Restriction financing limitations vary because of the condition

- Texts

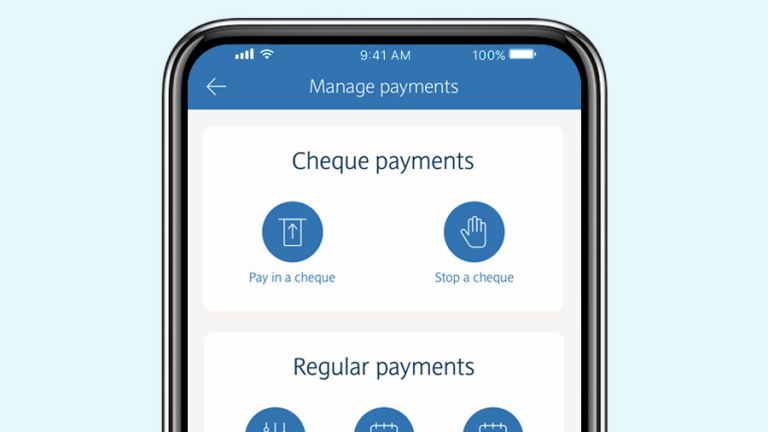

A map of your own United states exhibiting Part 184 financial approvals for the for every single county since , the newest chart the newest Homes and you will Metropolitan Advancement provides. Property And Metropolitan Creativity

Restrict loan restrictions will vary by condition

- Texting

- Print Copy blog post connect

Limitation loan constraints differ by the condition

- Texts

- Print Copy post hook up

TAHLEQUAH, Okla. — Of a lot Native Us citizens will get qualify for mortgage brokers through a U.S. Homes and you may Urban Innovation system that is existed for more than a couple years. The fresh Part 184 Indian Home loan Be certain that Program have versatile underwriting, isn’t really borrowing from the bank-get mainly based in fact it is Indigenous-certain.

Congress oriented it in the 1992 in order to assists homeownership inside advance to payday Delaware Indian Country, and some of their experts become low-down costs no individual home loan insurance rates.

“I simply believe it’s a beneficial system, and i purchased my domestic doing this,” Angi Hayes, financing originator having 1st Tribal Credit from inside the Tahlequah, said. “I just thought it’s so great, (a) system more some one should know and you can without a doubt brand new tribes should know.”

“Where I work, the audience is more educated all over the country, and thus we create a great deal more (184 finance) than simply most likely virtually any bank,” Hayes said. “There are lots of explanations it is probably better than FHA (Government Casing Management), USDA (You.S. Service from Farming) or old-fashioned mortgage. Frequently its less at the start. As an example, FHA is just about to cost you step 3.5 % down. We costs dos.25 percent.”

Hayes said into the Oklahoma the maximum mortgage she can currently give is $271,050. “The fresh debtor is actually adding one to other dos.25 %, so that the $271,050 is not necessarily the biggest cost you will get, it’s just the most significant loan amount I’m able to do.”

“That is probably the most significant myth into 184 loan, that always are involved with the tribe or having condition since Local Western, they usually tend to be a reduced or average-income situation,” she told you. “The stunning thing about the brand new 184 would be the fact that isn’t low-income and is also besides to have first-day homebuyers.”

Hayes said when you’re HUD has no need for a specific credit rating to meet the requirements, she demands a credit report to choose an applicant’s financial obligation-to-money ratio. She plus need shell out stubs, taxation and you can lender comments and at the very least two forms of borrowing from the bank which have one year worth of after the.

“I am able to tell people I am not saying a card counselor, however, due to the way we do our very own approvals, once i remove borrowing I’m taking a look at the meat of the declaration,” she said. “Basically, you place your revenue together with loans on the credit history therefore add it to this new suggested house commission. These two things to one another can not be more than 41 % regarding the complete revenues. Which is the way i determine how much you will be accepted getting.”

“I am shopping for no later payments in the last 12 months,” she told you. “Judgments, you should be a couple of years from the go out they is actually filed and you can reduced. We need no series that have stability if you do not possess evidence you to definitely you have got paid down at the least 1 year with it. When you need to view it wise practice, everything i share with men and women is that do not want to hold your own bad record facing you.”

The newest 184 mortgage is served by the lowest down-payment element 2.25 percent having money over $50,000 and you will 1.25 % to own loans below $50,000 and you will fees .25 percent per year getting private mortgage insurance. Since financing worthy of are at 78 per cent, the insurance will likely be fell. The consumer as well as will pay a single, 1.5 % loan percentage, that is paid-in cash but is always extra into the the borrowed funds count.

“Easily has someone walk in, We first want to uncover what the requirements try,” she said. “If your consumers should apply on their own, I will provide them with the equipment that they must see when they are happy to purchase. Once they simply want to do a much pick, We extremely advise individuals to get pre-accepted prior to they look at the property, simply because they are considering a thing that was way more than or way under their budget.”

The borrowed funds could also be used so you can re-finance an existing house home loan, Shay Smith, director of the tribe’s Home business Guidance Cardiovascular system, told you.

A new interest is that it can be joint on tribe’s Mortgage Assistance Program getting household orders. The brand new Chart assists people get ready for homeownership with individualized borrowing instruction and you can class studies while offering down-payment direction ranging from $10,000 in order to $20,000 to own first-time homebuyers. Yet not, Chart candidates need certainly to satisfy income advice, end up being earliest-big date homeowners, finish the called for documents and you can apps and you may finish the homebuyer’s training classes.

Work off Loan Ensure within HUD’s Work environment from Indigenous Western Applications pledges the fresh Area 184 home loan funds built to Indigenous consumers. The loan be certain that assurances the financial institution you to its resource might be reduced completely in case of foreclosures.

The fresh debtor enforce to the Point 184 financing which have an acting lender, and you may works closely with the group and you can Bureau away from Indian Situations if the leasing tribal belongings. The lending company next evaluates the mandatory financing files and you may submits brand new mortgage having acceptance to help you HUD’s Place of work off Loan Make sure.

The loan is limited in order to solitary-relatives homes (1-cuatro gadgets), and repaired-speed loans to have three decades from quicker. Neither adjustable rate mortgages (ARMs) neither industrial buildings qualify for Part 184 loans.

Money must be made in an eligible town. The program has grown to include eligible portion past tribal believe residential property.

Leave a Reply