One of several perennial drawing cards for all those wanting to move so you’re able to Clark County could have been the opportunity to either own an effective home to your acreage in the nation otherwise, inhabit one of the most significant okay short places close Vancouver, and maybe reduce slightly piece. It is reasonably a lower understood undeniable fact that truth be told there however was livliehoods going on with work and you will work found in brand new rural elements of new State. Making to acquire a house for the a rural urban area or, a rural property a lot more possible, the federal government through the Company of Farming (USDA) gives the Outlying Invention Unmarried Relatives Secured Financing System.

Background: Outlying The united states have a long history of high quality software on the All of us Bodies to market and you may improve quality of life and value to reside in a rural urban area. The latest Rural Construction Management (RHA) and you can Outlying Electrification Administration (today the latest Rural Utilities Solution – RUS) was in fact produced about New Package applications throughout the Higher Anxiety and you will Soil Pan weeks, and offered financial help so you can outlying portion for property also to deploy electrical shipments and phone infrastructure in order to outlying communities. To ensure, a giant power behind these types of apps will be to greatest be sure the healthiness of All of us Farming areas and the top dining offers for the nation. The federal government department handling this type of software are appropriately enough, the us Agencies of Farming (USDA). The brand new USDA Rural Innovation Mortgage has been in existence in regards to the same period of time, and has now progressed throughout the years to help you their newest progressive setting.

- Lower so you can Center-Money Home are usually eligible – Should your Home Money is simply too higher, you are ineligible.

- 31 Seasons Repaired Title Money during the The current Low interest — these are totally amortized funds with no gimmicks.

- Qualifying rations is actually 31% having Property and you will 41% to possess overall obligations.

- Guarantee Payment applies, and might end up being rolling for the financing.

- Zero Cash necessary for this new Deposit. Actually certain or all Customer’s Closing costs tends to be funded when the eligible.

- Flexible Credit Guidelines, where low-traditional histories is accepted.

- Eligible services tend to be: Established Belongings, The newest Construction, The new Are designed Belongings, Modular Property, and qualified Apartments!

- Qualified Repairs could be included in the loan too!

- Candidates apply which have an approved bank of its possibilities (we understand several a good recognized lenders).

Exactly what Elements of Clark County Qualify on the USDA Family Mortgage?

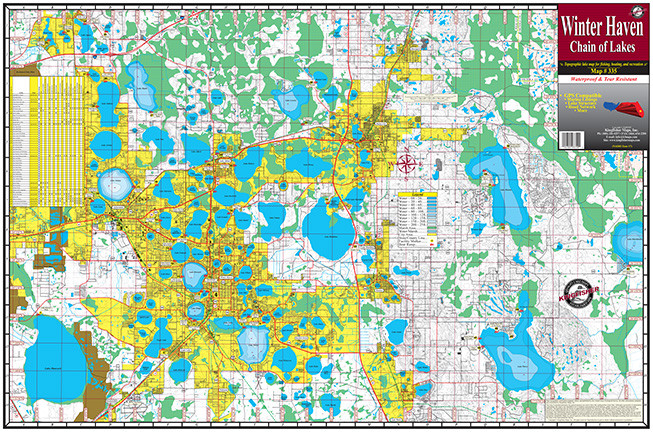

Having Clark State getting part of the greater Portland / Vancouver city city, brand new USDA has provided a chart of your Ineligible southern area of the County and thus, the remainder north part of the County is approved. This is basically the map due to the new USDA:

Each of Amboy, Los angeles Center and you can Yacolt;Brand new Clark State Portion of the Woodland zip code;Ridgefield northern from 179th Street;most of Clean Prairie and you may Hockinson. For these the property must be away from area limits: Competition Surface, Camas and you may Washougal. Improve 2018: Elements today excluded is actually inside urban area restrictions out of Competition Soil, Camas and you can Washougal.

Any kind of Almost every other Very important What to Which Mortgage Program?

Hence, which loan can not be useful a rental Possessions or, become a major fixer. If not, a comparatively significant number of one’s outlying Clark State belongings should qualify.

While i was growing up Clark Condition was still thought good mostly rural town nevertheless now, there’s been considerable increases into extent it will either getting unbelievable discover however a substantial amount of “rural Clark County” left! I have caused numerous readers that really including the advantages on the program.

For those who have a desire for these types of mortgage and you loans in Butler will house buy excite call me (John Slocum) on 360-241-7232 .

Leave a Reply