Payment Record

Payment record stands as the a foundation in the choosing your credit rating, wielding big dictate over your property equity mortgage possibilities.

Your fee history shows your texture in the fulfilling previous borrowing from the bank obligations. This is a critical indicator of one’s probability to get to know upcoming costs, it is therefore essential for individuals to maintain tabs on quick money.

An applaudable record out-of on-day repayments not just elevates your credit score as well as ranking your just like the a decreased-exposure applicant on eyes regarding loan providers, boosting your possibility to possess positive mortgage conditions.

Borrowing from the bank Use Proportion

Another important function is the borrowing usage ratio, which stands for the fresh new proportion of your readily available borrowing from the bank which is already used.

The financing utilization ratio-the bill within borrowing use while the borrowing open to you-performs a pivotal character inside the framing your credit rating. Maintaining a reduced ratio are an indicator off disciplined credit management, suggesting that you are not extremely depending for the borrowing to suit your economic requires.

Loan providers like consumers which have all the way down ratios, seeing them once the less likely to standard towards the this new borrowing. Of the carefully managing your credit use, you could potentially significantly change your financing qualification and you may safer more advantageous terms, underscoring the importance of which factor in your financial wellness.

Less ratio is actually indicative out of voice credit government, signaling in order to loan providers that you’re a diminished-risk debtor. It proportion underscores the importance of balancing borrowing utilize having available limits to enhance your own attractiveness to lenders.

Together, such issues play a crucial role from inside the choosing the brand new regards to your home guarantee loan. By the targeting improving such key areas of your credit rating, you could potentially standing yourself a lot more definitely throughout the eyes of loan providers, possibly securing a whole lot more useful financing words.

Consistent Into-time Expenses Money

Uniform, on-big date bill payments are essential to own maintaining a strong credit rating, while they truly think on your fee record. It precision into the appointment financial obligations signals to help you loan providers the honesty because a debtor, enhancing your prospects for advantageous mortgage conditions. Establishing a typical regarding punctual payments try a foundation technique for individuals trying reinforce their borrowing from the bank character.

Cutting Personal credit card debt

Earnestly lowering your personal credit card debt plays a pivotal character from inside the improving your credit rating of the lowering your borrowing from the bank utilization proportion.

Showing fiscal duty as a result of financial obligation protection just allows you to a lot more attractive to loan providers but also strengthens your general monetary health. This method was instrumental for the securing funds with additional advantageous words and you can conditions.

Restricting The newest Credit Inquiries

Restricting new borrowing small loan Oronoque no credit check concerns are a strategic go on to safeguard the credit history from a lot of decrease. For each and every the inquiry is slightly decrease your rating, as it might indicate an elevated chance of economic overextension.

When you’re judicious in the where and when you apply for the brand new credit, you can preserve or increase credit rating, and thus improving your eligibility getting advanced financing choices.

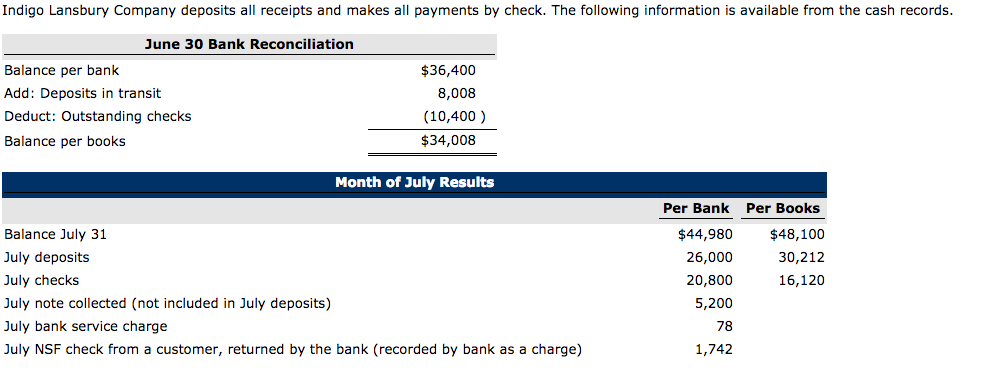

Most recent Traditional Mortgage Pricing

Once the a dependable mortgage lender, we in the Spring season Financial support imagine old-fashioned finance a well-known choice once the of the reasonable cost that produce purchasing a property smaller financially tiring for our customers.

The most popular variety of antique financing, the latest repaired-rate old-fashioned financing keeps the typical rates away from step three% Apr (Apr) getting a 30-seasons mortgage.

Just how is actually Old-fashioned Loan Pricing Determined?

While we really worth our very own consumers in Dash Financing, it is important that we permit them to know the way antique financing rates are determined considering points which might be plus part of one’s requirements getting protecting a conventional mortgage.

- Credit score. A property client with a higher credit history is given a reduced price than just a buyer that have a lowered credit history. Such, a buyer will likely be given on 0.5% all the way down rate if they provides a 740 credit score and you will a 20% off.

Leave a Reply