Unlocking the best refinance words

Refinancing the home loan is like dating-inquiring just the right questions initial can save you an environment of troubles down the line. Just as you wouldn’t commit to a love without knowing the brand new concepts, diving to the an excellent refinance without proper question will cost you big style.

Good and bad times so you can re-finance

Solutions – whenever financial costs try dropping fast – when refinancing was a zero-brainer. Taking your brand-new price was at minimum 0.5% less than your you to, refinancing is generally beneficial.

And, out of , financial costs were on the an obvious downwards pattern, although there had been loads of highs and you can troughs in the act. Very, most residents refinanced periodically.

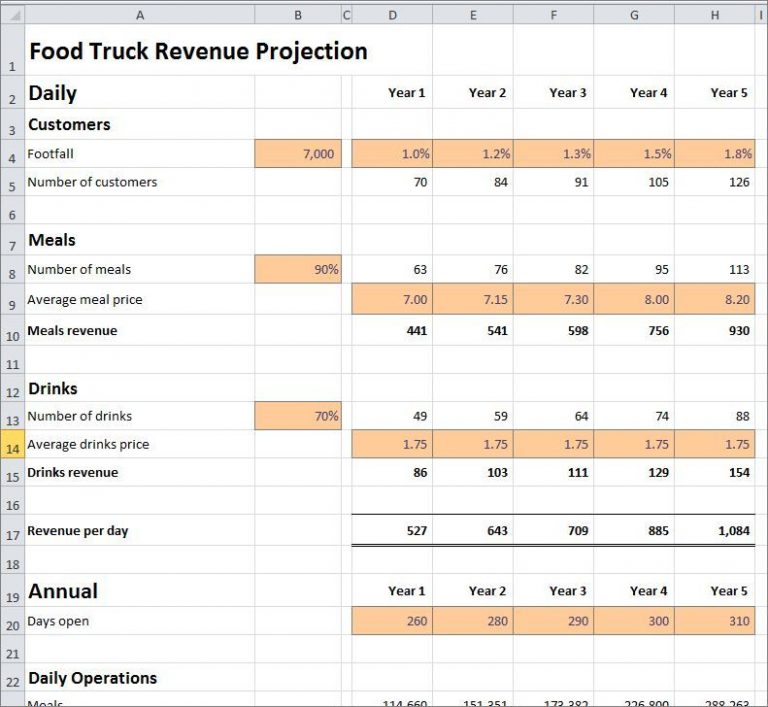

Source: Freddie Mac computer, 30-12 months Fixed Rates Financial Mediocre in the united states, recovered off FRED, Government Reserve Financial out-of St. Louis

However,, as start of 2021, up to this post are written, mortgage costs was basically towards the an ascending pattern. And you will less people have been refinancing.

Fannie mae reckons one, in month ending , brand new dollar level of refinance software is off 88.6% than the refinance boom you to occurred when you look at the third one-fourth from 2020.

- And come up with a high payment per month

- Stretching out enough time they might be purchasing their property, usually adding notably to your total matter their attention will definitely cost them

Of course, each of us aspire to understand the come back regarding a slipping development inside the home loan pricing; property owners will save many. Nonetheless it had not yet showed up when this blog post is actually written.

When refinancing is useful even after rising pricing

Refinancings is rarer than just they were in the past however, obtained much out-of disappeared. People still score valuable advantages from all of them. So, what can people feel?

Well, periodically, somebody who closely monitors home loan prices you will place your newest mortgage speed was 0.5% below their current rates. After that, they may carry out a great rate-and-term refinance, that may submit less financial rate instead of extending the mortgage identity.

Cash-away refinances are going to be a good

But, generally, it’s because some body requires a profit-aside refinance. Your replace your present home loan with a more impressive that and you may go away that have a lump sum payment of one’s variation, minus settlement costs.

When you find yourself refinancing so you can a bigger mortgage on a higher level, you can find noticeable downsides. You will be extremely probably rating a greater payment and you can the entire cost of borrowing from the bank to buy your domestic rockets.

That isn’t particular. Such as for instance, in the event the credit history is significantly higher and your debt obligations below after you taken out your existing mortgage, you are provided a minimal rate. Your economic products will have required transformed so you’re able to score near to compensating having financial rates’ rising development.

You may be in a position to modest the result in your monthly payment (perhaps even score a lower one to) of the stretching the amount of time you take to spend down your house financing.

Eg, guess your existing 31-12 months home loan has been choosing two decades. When you get another 29-12 months financing, you’re going to be spread your repayments more than 50 years. Which can help along with your monthly premiums however, will be sending the newest total count you only pay inside the interest sky high.

Therefore, why refinance? Due to the fact sometimes need a finances treatment so terribly that (primarily deferred) pain is really worth they. Consider you have crippling expenses you to definitely threaten every facet of your own lifestyle, together decisive link with your home. Otherwise which you have already been another dollars-hungry team. Otherwise that you will be unexpectedly faced with an inevitable and you will unplanned connection.

Perhaps an earnings-aside refinance is the best way forward. But, before deciding on that, here are some home equity loans and domestic equity lines of credit (HELOCs). With this next mortgage loans, your home loan stays in position therefore spend increased speed merely on the new borrowing.

Leave a Reply