Financial Taxation Deduction Calculator

There can be usually not much to acquire enthusiastic about in terms in order to income tax 12 months, with the exception of the awaited returns additionally the write-offs you could deduct to what your debt the government.

To have homeowners, home loan appeal taxation deductions was a tax season gold lining. Out of top mortgages in order to home collateral-established finance, mortgage taxation deductions come lower than different real estate loan products. You could influence the financial taxation deductions while they interact with the eye you may have paid off building, to acquire, or enhancing your family up against your own nonexempt earnings.

Our home Loan Professional is here to aid homeowners to determine the mortgage notice deductions they are eligible to located. We shall walk you through what a mortgage tax deduction are, the monetary advice expected to assess your deduction, and you will financial notice deduction restrictions.

Regarding monthly installments so you can domestic maintenance and possession costs, the list of rapidly-built-up expenditures can also be deter you from trying to buy your dream family. Mortgage attention tax deductions was in fact instated as a reward to find borrowers to shop for home. This is accomplished by allowing that deduct specific expenditures your bear regarding the income tax season out of your nonexempt earnings. It is popular with home owners who wish to ideal standing themselves economically by reducing the amount of money they should spend inside taxes.

How can i Assess My Mortgage Tax Borrowing from the bank?

- You submitted an Internal revenue service mode good site 1040 and you will itemized their deductions

- The loan try a guaranteed debt into an experienced domestic that you own

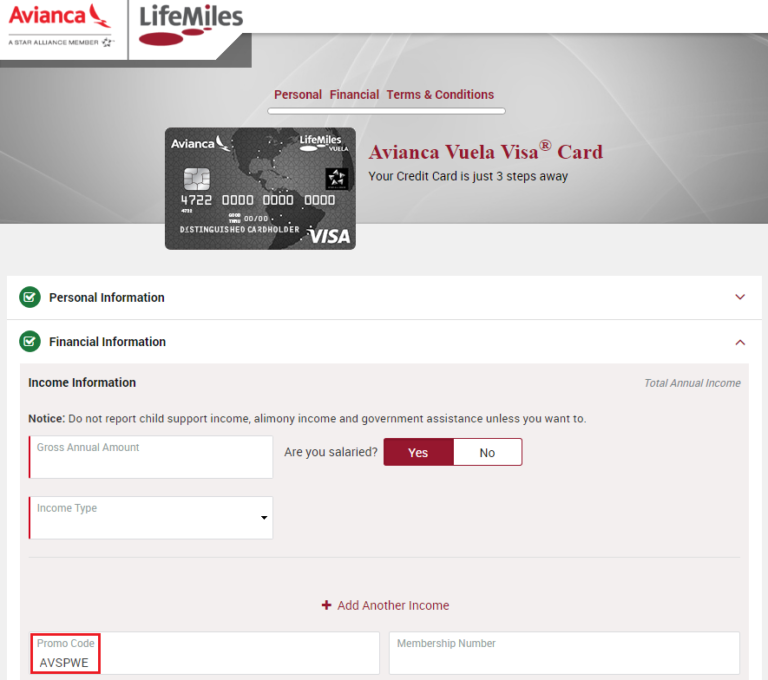

Up coming, make an effort to do some research into admission fields below to help you determine your own projected mortgage attention tax deduction.

- Mortgage Amount. Here is the overall number your took out for your home loan financing.

- Mortgage Term in years. Extremely home loans try given from the 15 otherwise 31-seasons name durations.

- Annual Interest. Their annual interest is dependent on whether your rate is restricted or changeable. Fixed interest levels are undamaged on life of your loan. Varying rates reset from time to time into the alignment that have sector changes, that produce your rate of interest to improve otherwise fall off.

- Government Income tax Price. This is actually the marginal federal income tax speed you would expect to spend depending on your own taxable money.

- Condition Income tax Rates. This is basically the marginal state tax rate you expect to pay.

- Payment per month. Enter your arranged monthly payments because of it input. It can were dominating, attract, and other charges that are folded into your complete mortgage payment.

- Rate of interest Shortly after Fees. Here is the yearly effective interest rate immediately following taxation try pulled into consideration. Its impacted by home loan personal debt constraints.

Around 2021’s basic income tax deduction, single-tax-payers qualify for a great $12,five-hundred deduction when you find yourself married couples processing joint taxation qualify for an excellent $25,100 deduction. Note that itemized deductions are categorized as with your home mortgage to order, create, or somewhat change your home. You can manage to subtract attention into the a house equity loan otherwise personal line of credit (HELOC), provided the borrowed funds was utilized for one of those about three purposes.

Which calculator assumes on that itemized deductions have a tendency to exceed the quality deduction for the taxation filing reputation. If your itemized write-offs dont go beyond your own important deduction, the advantage of deducting the eye on the family could well be shorter otherwise eliminated. Keep in mind if one makes a higher income enabling for your itemized write-offs becoming eliminated, your own overall income tax deals is less.

Are there Financial Interest Tax Deduction Restrictions?

Calculating your own financial desire income tax deduction restrict makes it possible to pick in the event that a standardized otherwise itemized income tax deduction ‘s the right choice for you economically. The newest TCJA states that there’s a threshold on how much you could deduct. As reported by Irs regulations, single-document taxpayers and you can married people submitting mutual taxation can also be subtract domestic mortgage appeal on the very first $750,000, or, $375,000 while you are hitched however, submitting separately.

Getting residents which sustained indebtedness ahead of , the utmost financial focus tax deduction is decided at $1 million getting single-file taxpayers and ount are less to help you $five-hundred,000 while partnered but submitting alone. Write-offs are also minimal for individuals who took out home financing to possess factors aside from to invest in, build, or replace your domestic.

How do The home Loan Specialist help?

The main Financial Expert’s dedication to bringing home buyers an informed price it is possible to on their financing also means making them aware of tax deductions they may be able make the most of to position themselves best financially. Home financing notice taxation calculator is a superb starting place when quoting how much you might be capable deduct off your federal and state taxes this present year. Talking to a educated financing Pros can describe what qualifies due to the fact a home loan taxation deduction.

Our team out-of friendly lending Advantages is selected regarding the same teams i serve. This is going to make you accustomed the clients’ means and able to connect with what you’re going through while the residents. We know that if it comes to offers, all bit assists!

Therefore call us today within 800-991-6494 to talk to one of our savvy credit Advantages, that will help you regulate how much it can save you this taxation season which have mortgage taxation deductions. We could also be reached using the application to ascertain if a mortgage income tax deduction is one of financially proper alternative to suit your private cash today.

Leave a Reply