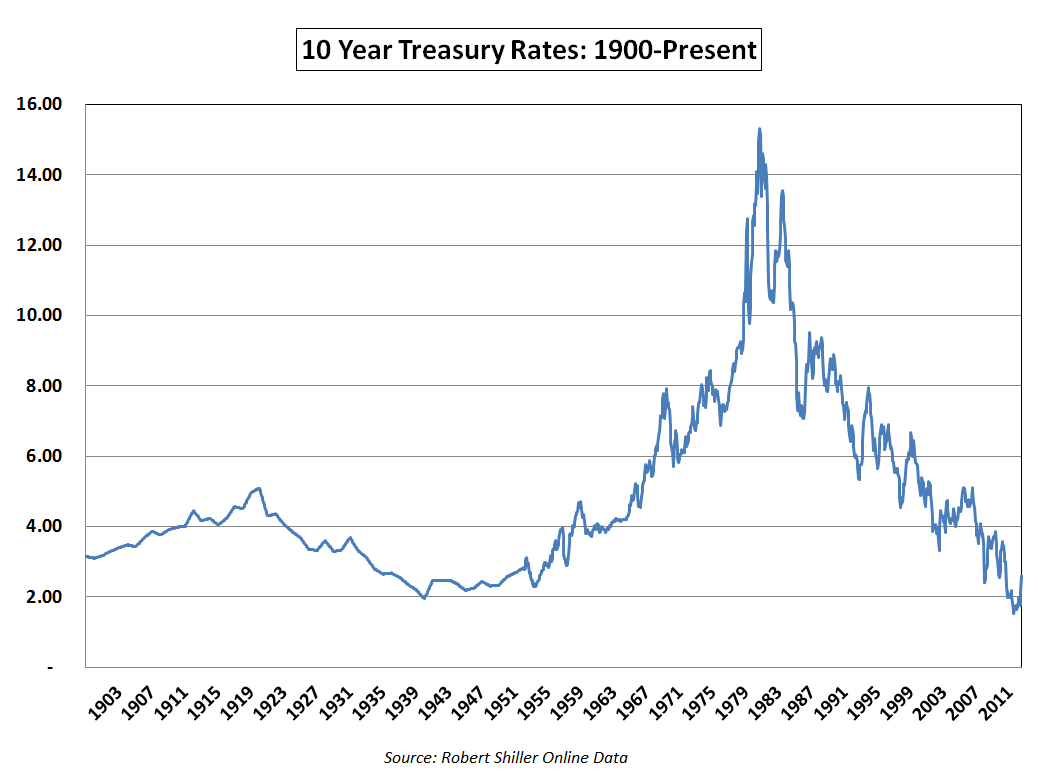

5 percent and you will cuatro.5 per cent on center of 2013 for the first pair regarding weeks inside 2020, taking relative balance to have homebuyers and the ones trying re-finance present fund.

Incase the brand new COVID pandemic ushered in approximately 1 . 5 years out-of diminishing costs one sunk to historic downs regarding nearly dos.5 % and you may domestic conversion process leaped, mortgage brokers and you may agents you will scarcely keep up with the booming organization.

Given that increase has gone bust in a rush, as the rates rocketed regarding lower than 3 per cent lower than annually . 5 ago to around 7 % today. Brand new ensuing whiplash brought about loan applications to diving, in accordance with refinancing almost nonexistent, mortgage lenders need to believe in house conversion, which have in addition to refuted somewhat.

Most of the time, prices having a thirty-year-repaired home mortgage resided anywhere between step three

During the 2022, current You.S. household conversion process decrease 17.8 percent out-of 2021, the latest weakest season getting household conversion process due to the fact 2014 as well as the biggest yearly , according to National Association out of Real estate professionals.

To own Jesse Sasso, branch movie director and you may loan administrator during the Figure Home loan within the Huntington, the difficult ecosystem features forced him along with his acquaintances to go back to maxims

The difficulty is forcing those in the fresh new home-based mortgage industry so you’re able to find a method to coastline upwards its base outlines. Some have come up with the fresh financing things, of a lot provides stepped-up business and others is returning to networking and banging new phones.

We had been rotten to own such a long time throughout COVID, with lower-clinging fruits and you can extremely ridiculous, unusual costs that people was basically speaing frankly about. We had been thus hectic churning aside refinances we forgotten reach to your way that we did company, Sasso advised LIBN. Our business design sought out the newest screen since we had been therefore active. We did not even talk with anybody.

Exactly what I am undertaking today as that loan administrator, I’m providing this time around to get out around once more and you may meet with folks, foot-to-foot, nostrils-to-nostrils, select anyone, realtors, lawyer, and extremely plant my personal seed again, he said.

Andrew Russell, manager and you will inventor away from RCG Home loan for the Hauppauge, claims their company are navigating brand new reality that have an equivalent strategy. Andrew Russell, RCG Financial

Now into the providers a bit much harder and also you you should never learn if the second customer is on its way, our company is time for maxims, Russell told you. We have been and come up with a far more competitive try in the marketing, ensuring that we’re escaping indeed there at the incidents. Time for dated-school contacting, such dialing having bucks, contacting current real estate professionals otherwise real estate professionals which might be lead generation who do organization and inquiring them to split cash or provides a cup coffee, otherwise sit-in our very own work environment inside the Hauppauge to see what we should can do for their business and get a popular mate of theirs.

RCG will even expand the visited. Whenever you are throughout the ninety per cent of its company currently develop into the The new York State, Russell says he or she is using the company’s operate on the move, bad credit line trying plan money for the urban centers instance Texas, Florida, Nj-new jersey and Pennsylvania.

My mission is through the new 4th quarter, or even the coming year within newest, one 50 % of one’s design are regarding out-of condition, Russell told you.

To help relieve the pain of highest prices, Julian Giaquinto, department manager from Advisers Home loan Group’s Wantagh workplace, is offering consumers something called an excellent two-for-one to purchase-down, and therefore reduces money towards the a predetermined-rates financial towards the first two many years. Julian Giaquinto, Advisors Financial Classification

The way it works is family suppliers invest in a 2 % concession on paper that will not apply at its websites continues however, caters to to attenuate this new consumer’s rates. Including, whether your price try seven percent, it might be quicker to 5 percent on the first 12 months and price visits six percent next season. From inside the seasons about three it goes back into eight % that is the interest rate for the remainder of the term.

Leave a Reply