Bringing homeownership options has been a lot more of a warmth rather than a job in order to Ella. She’s got worked with church buildings, schools, civic teams and others to add recommendations and you may assistance to somebody being effective home owners.

Ella’s is the widow away from an impaired Western Experienced, the mother of step three adult college students and you may 3 wonderful grandsons. Ella has just moved to Jackson, TN close friends as well as in their own solution market which can be happy on enabling so much more Tennesseans end up being residents.

B. Fannie Mae’s HomeReady 3% down antique program- So it 3% program is great to compare contrary to the FHA financing

Whichever Your priorities was, my work is to acquire the mortgage terminology one to will give you bragging legal rights once you explore they and make it easier to score to the hitting your aims . Just like the a mortgage loan manager, my personal job is to acquire towards professionals you wanted from the funding words loan places Rye. What exactly is important to you? I’m able to assist you in finding the financing words that may help you you are free to what you want. What is actually your own comfort level on property payment? Exactly how much are you comfortable paying down,? What kind of funding do you need to obtain the household we would like to buy or refinance? Some other readers keeps some other goals in life-most are to order the basic house with little or no advance payment fund. Some are going through scientific demands, divorces otherwise getting ready to send children to college and many was embarking on a permanent goal of to get characteristics to create leasing income.

Jo Gather is actually a home loan administrator that have thorough knowledge when you look at the tailoring mortgage loans to her consumers who will be refinancing otherwise to shop for property most of the along side country. Jo can help you look at book versus purchase, if this is practical so you’re able to re-finance, how to get the best contract on the house get financial support.

This lady has spent some time working in different aspects of retail and wholesale credit along with financing processor, antique and you may bodies underwriter, supplementary marketing and processes director and you may financing manager

Jo Garner has been around the actual estate/resource business for over two decades. She had her come from Portland, Maine where she basic first started their own home job. She obtained her a residential property studies throughout the School from South Maine and you can are truly mentored for the North park, Ca by the Robert Grams. Allen, writer of Absolutely nothing Off, Undertaking Wide range and Challenge.

Alia (maybe not their unique genuine title) got ok borrowing from the bank and you will a beneficial steady income, just not money to fund this new advance payment. She don’t find out about the new Tennessee Houses Development Company off percentage guidance programs incase We told her it appeared to be THDA could help their own get the special $fifteen,000 Most difficult Struck advance payment recommendations, for the first time she acceptance by herself discover delighted. Even as we had nearer to closing she started initially to initiate giving right up once more. Looking to figure whey she was willing to ruin their options for a house, We been inquiring concerns. She shared throughout the her traumatic youthfulness sense in the event the family where she and her household members stayed is actually missing by a devastating feel. To your reassurance away from her family members in the office, their real estate professional and of course the financial group, this woman went to their unique closure and you will chuckled, next cried (for glee) and then chuckled once again. To purchase her own home with the assistance of THDA along with her realtors, the day she closed on her household is actually an optimistic turning point to possess Alia Abbey.

HHF-DPA system Great Possibilities Plus Homeownership to your Brave HBEI THDA’s site: GreatChoiceTN Info to own Bank, Real estate agents and you can Homeowners

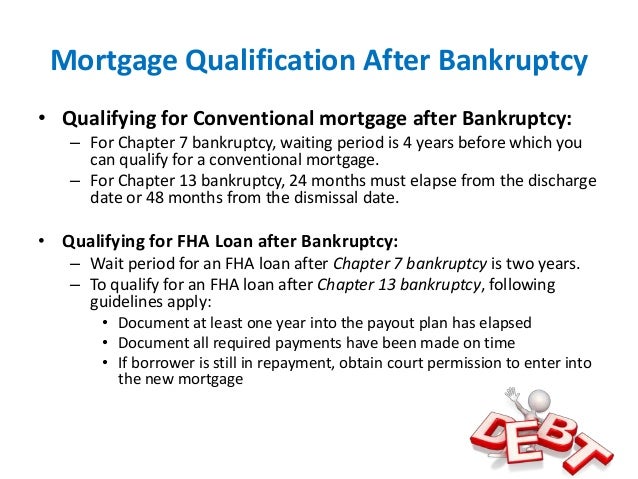

7. What other home loan programs can be utilized in combination with THDA down-payment guidance? THDA are not now offers down payment assist with be studied to own a beneficial down payment, settlement costs or prepaid fees and you will insurance policies to own consumers by using the FHA loan program, Va loan program, USDA Rural Homes program.

The latest HomeReady program has an optimum earnings house restriction influenced by the official and you will state in which the subject home is receive.

Ella L. Harris, Consumer Account Manager (Western Tennessee Area) to possess THDA provides more 40 years out-of mortgage credit experience. Ella has worked in the private and you will regulators circles within the the borrowed funds business and you will previously held a bona-fide home license inside the the state of Georgia. Their particular functions experience written occupations you to definitely took their particular to numerous says and you will due to of several business alter.

Leave a Reply