Solution Players

If you’re currently offering towards the effective responsibility throughout the armed forces, you are qualified to receive a good Virtual assistant mortgage immediately after offering in the the very least 181 carried on days.

Such, you happen to be eligible immediately after offering merely ninety days for those who was in fact implemented otherwise are a member of Federal Shield or Supplies exactly who offered about 3 months out-of productive service during the wartime. The newest Virtual assistant also has unique qualification provisions needless to say scenarios such are a prisoner-of-war otherwise researching a red Cardiovascular system.

It is vital to keep in mind that eligibility standards can alter over the years, so it is far better talk to a beneficial Va-recognized lender or even the Virtual assistant right to know if you meet the present day service conditions.

How Virtual assistant Funds Examine

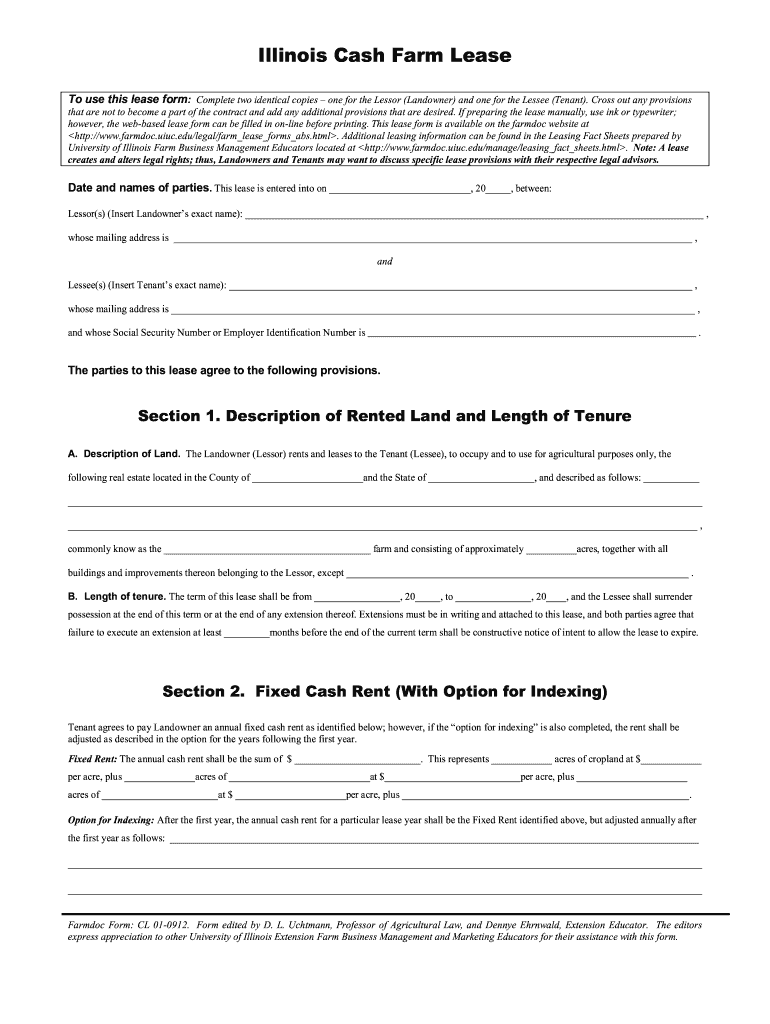

When you find yourself Va financing provide advantages, it’s beneficial to recognize how they accumulate against almost every other preferred mortgage options particularly traditional loans and you may FHA funds . The following is an easy analysis:

Va money normally provide straight down Virtual assistant household rates plus versatile credit requirements than simply antique loans and personal loan providers. While doing so, traditional financing require individual mortgage insurance coverage for those who put down quicker than just 20%, when you’re Va loans never wanted PMI.

Versus FHA loans, being covered because of the Federal Homes Government and invite to have low-down payments, Va money tend to have all the way down full costs.

While you are FHA funds enable it to be off payments as little as step 3.5%, needed each other an initial financial top and ongoing yearly premium, that will put significant will set you back across the lifetime of the loan. Virtual assistant money need no home loan insurance at all.

So it dining table will bring a definite testing regarding secret possess like rates of interest, credit standards, PMI (Private Financial Insurance rates) requirements, complete can cost you, and you may down payment expectations for each financing variety of.

In many cases, Virtual assistant finance can be the least expensive financial choice readily available especially for individuals with down credit ratings otherwise restricted loans to possess a deposit.

Variety of Veteran Fund

The Virtual assistant now offers a number of sort of home loans meet up with the latest varied requires from eligible individuals. We have found an introduction to some of the most preferred Virtual assistant loan options:

Va Interest Protection Refinance loan

These types of Va mortgage, often called an excellent Virtual assistant Improve Re-finance , allows property owners exactly who curently have a preexisting Virtual assistant financing in order to re-finance its mortgage for taking advantageous asset of all the way down interest levels. The brand new IRRRL generally relates to faster documentation and you can underwriting than simply a simple refinance.

A keen IRRRL could easily lower your month-to-month home loan repayments and you may conserve you many over the lifetime of the loan by protecting a lower interest. Yet not, you simply can’t need cash-out with this particular re-finance paydayloansconnecticut.com/gaylordsville/ solution.

This new Va Purchase Financing , also referred to as an effective Virtual assistant home loan, is the most widely used form of Va loan. Just like the title implies, this financing can be used to finance the purchase off an initial quarters for eligible borrowers.

Having good Va Get Loan, qualified consumers is finance as much as 100% of the residence’s worthy of with no downpayment requisite, as long as the purchase price cannot surpass new appraised really worth. The newest Va and additionally hats particular closing costs that the borrower is actually permitted to pay.

Virtual assistant High efficiency Financial

The fresh Virtual assistant Energy-efficient Mortgage (EEM) was designed to allow pros to finance the price of times abilities improvements within their Va mortgage. This 1 can be obtained both for Virtual assistant Purchase Financing and Va Re-finance Finance.

New EEM is cover individuals enhancements, such as for instance starting times-efficient screen, insulation, otherwise cooling and heating expertise, that may eventually cut homeowners on the utility bills and you may lead so you’re able to environment conservation.

Leave a Reply