Discover the positives and negatives of employing a home collateral line from credit (HELOC) to repay their tax obligations this year.

Is-it smart to fool around with an effective HELOC to invest taxation?

Taxation season towards the financial year 2022 is among us, and while particular anticipate bringing cash return from Cousin Sam, other people folks have the feared development: we owe the Irs, perhaps over we prepared to own.

Perhaps the development originated your own accountant otherwise on the internet income tax app, it is typical feeling overloaded. Finding a huge, unanticipated statement never feels good. When you are in a situation for which you owe significantly more than you can make use of spend, there are lots of alternatives for how-to pay, even though you percentage from inside the $255 payday loans online same day Alaska more than your head.

These types of are priced between Irs repayment preparations, handmade cards, personal loans, and you will experiencing your residence security in the form of a good household guarantee mortgage otherwise home security personal line of credit (HELOC). Keep reading to know about the benefits and you will downsides of the many options available to create the best choice on your own and you will family unit members.

A means to shell out taxes into the Irs

Fee entirely through the Irs webpage. Commission selection is dollars, check, wire import, money buy, or elizabeth-percentage using your accountant or taxation application. So it avoids investing people charges, desire, or charges, and is and the reduced-costs solution. Although not, this might be choice is not always available without having cash on give.

A beneficial HELOC or other lowest-interest financing. The Internal revenue service recommends reduced-appeal loans or lines of credit as the a very economic method to fund income tax financial obligation over the years, on account of straight down rates, charges, and fees.

Apply for an Irs payment bundle. Short-name (around 180 months) or a lot of time-title (over 180 months) commission plans appear. This may include a monthly punishment and you will substance every day from the 7% attention.

Mastercard. A charge card would be a last lodge, because so many credit cards feature a high-rate of interest, making the overall number paid down over the years more than when the using almost every other money possibilities.

If you have the money to cover your own income tax obligations, you can use make use of family savings, electronic fund detachment from the taxation app, debit cards, wire import, cash, view, otherwise electronic purse application and also make percentage in full.

Whenever make payment on complete tax number actually an alternative, the newest Internal revenue service enables you to apply for an enthusiastic Internal revenue service small-title cost bundle ( below 180 days), a keen Irs much time-title installment bundle (over 180 weeks), otherwise, as many individuals manage, move to credit cards.

Internal revenue service percentage preparations do not become cost-free. Later punishment is applied to your complete financial obligation and you may focus ingredients everyday with the balance up until it is paid. Handmade cards as well as usually have high interest rates, causing them to a poor choice for settling income tax loans unless of course you intend to invest on the balance easily.

The inner Revenue Provider (IRS) suggests you to taxpayers mention private loan alternatives in advance of examining fee agreements, because of the penalties and interest of the repayment plans they give you. According to Internal revenue service:

In some cases, mortgage can cost you may be lower than the mixture interesting and you can penalties the fresh new Irs need certainly to costs significantly less than federal legislation. Usually, the fresh later-percentage punishment are 0.5% a month, not to ever go beyond 25% away from delinquent taxes. If the a taxpayer can not get financing, the fresh Irs now offers other available choices.

The present day Irs interest rate are 7% each and every day, compounding every day, on top of the .5% month-to-month punishment. Predicated on Credit Forest, the average credit card rate of interest in the usa now try %.

In contrast, when you have built collateral of your house, you will be qualified to receive property equity personal line of credit (HELOC), which generally carries an interest rate ranging from 5-8%. This might be most lower than a charge card or the daily compounding interest with the an enthusiastic Irs installment bundle. Having fun with a HELOC to invest their taxation can reduce the full number you only pay over time.

Using a HELOC to pay for this year’s fees

If you need to borrow funds to pay off the taxes and also built up guarantee of your house, a great HELOC is the best choice to adopt. Installment arrangements supplied by this new Irs, credit cards, and personal financing, can be all the come with highest-interest levels conducive to a higher overall cost than a HELOC.

A property Collateral Line of credit (HELOC) is a kind of borrowing that allows homeowners in order to make use of the collateral they usually have gathered in their home and employ it just like the guarantee to your a credit line. A portion of the advantages of checking a good HELOC ‘s the use of large amounts off resource, down interest rates than other credit solutions, simple and fast acceptance, and versatile fee agreements.

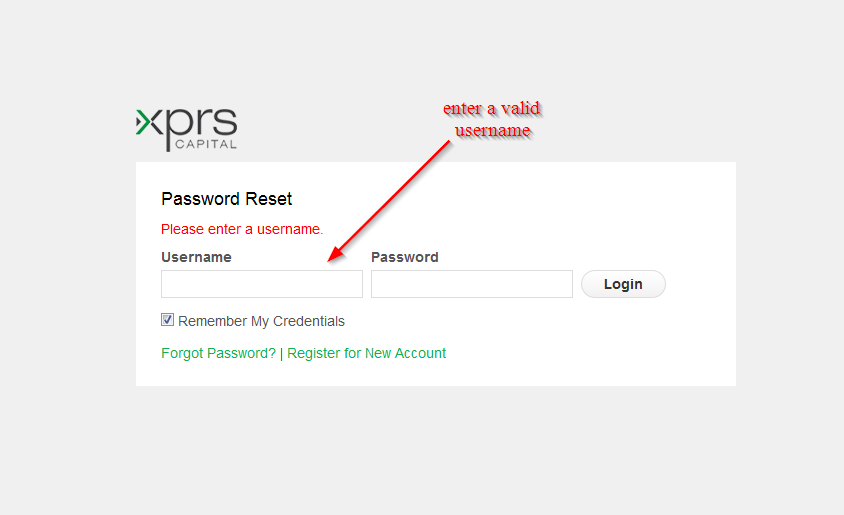

Applying for a HELOC is quick and simple, usually taking around step three-5 months. Home owners are acknowledged for 80% of worth of their property collateral. Security try determined out of a recently available assessment, deducting the total amount your debt into the present financial(s) on the worth of your house.

Antique, house collateral financing and you will house collateral line (HELOC) notice are tax-deductible, so it’s a powerful way to access cash while you are reducing your annual tax bill. However, in the 2017 Congress passed the 2017 Taxation Incisions and you can Operate Act (TCJA), which somewhat restricted taxation write-offs. Now, you can deduct notice costs on the home security debt on condition that you utilize the cash so you can “purchase, make, or create large renovations.” Furthermore, attract payments can simply getting subtracted toward first $750,000 of one’s HELOC (in the event that filing partnered, jointly), or the first $375,000 (when the submitting just like the one).

Secret Takeaways:

You are not alone whenever you are that have a big outstanding tax financial obligation this year. Even though it is daunting, there are many options available to you personally to settle their debt.

A great HELOC (house equity credit line) is additionally a good replacement for handmade cards and Irs cost commission intentions to pay-off taxation debt, due to down charge and you may rates of interest.

An excellent HELOC (home collateral line of credit) is the one equipment to create off their tax personal debt whether it is actually gotten during the otherwise before tax seasons you borrowed, Therefore was used so you can “buy, build, or build good renovations.”

Relevant articles

HELOC draw months is the big date during which you could potentially withdraw money from your residence guarantee personal line of credit. Understand exactly how it truly does work in this guide.

HELOC installment is the several months when you pay off the balance of your home guarantee line of credit. Understand the goals, how it works, and the ways to manage your repayments effortlessly.

Losing trailing toward HELOC money have really serious effects, and additionally foreclosure. See how to proceed if you can’t create repayments on your HELOC.

Leave a Reply