This article demonstrates to you exactly what an enthusiastic LTV proportion try and just how your can determine it to work out how much put you’ll need to help you qualify for a good LTV ratio.

- Specialist Articles

- Inquire The newest Pro

90%, 80%, 70% – this may all of the sound like lots from proportions which means that only you can’t overlook the LTV price for a financial when you’re to purchase a home. All the financial deliver her LTV proportion plus the that you might be entitled to sign up for matters for the money.

Jumping to the next number of LTV ratio can help you conserve many over the time of their financial as straight down the newest LTV proportion, the lower your monthly home loan repayments would be therefore the smaller number of desire you’ll pay more your name.

But what makes one to? This article demonstrates to you what an enthusiastic LTV proportion try and just how your can estimate it to work out how much deposit you want so you can be eligible for an excellent LTV ratio.

If you get a home loan, you can find you should make sure which affect how well a deal you’ll get and in the end, just how much you pay monthly. Rates are one of those circumstances however, something that try usually skipped ‘s the LTV speed.

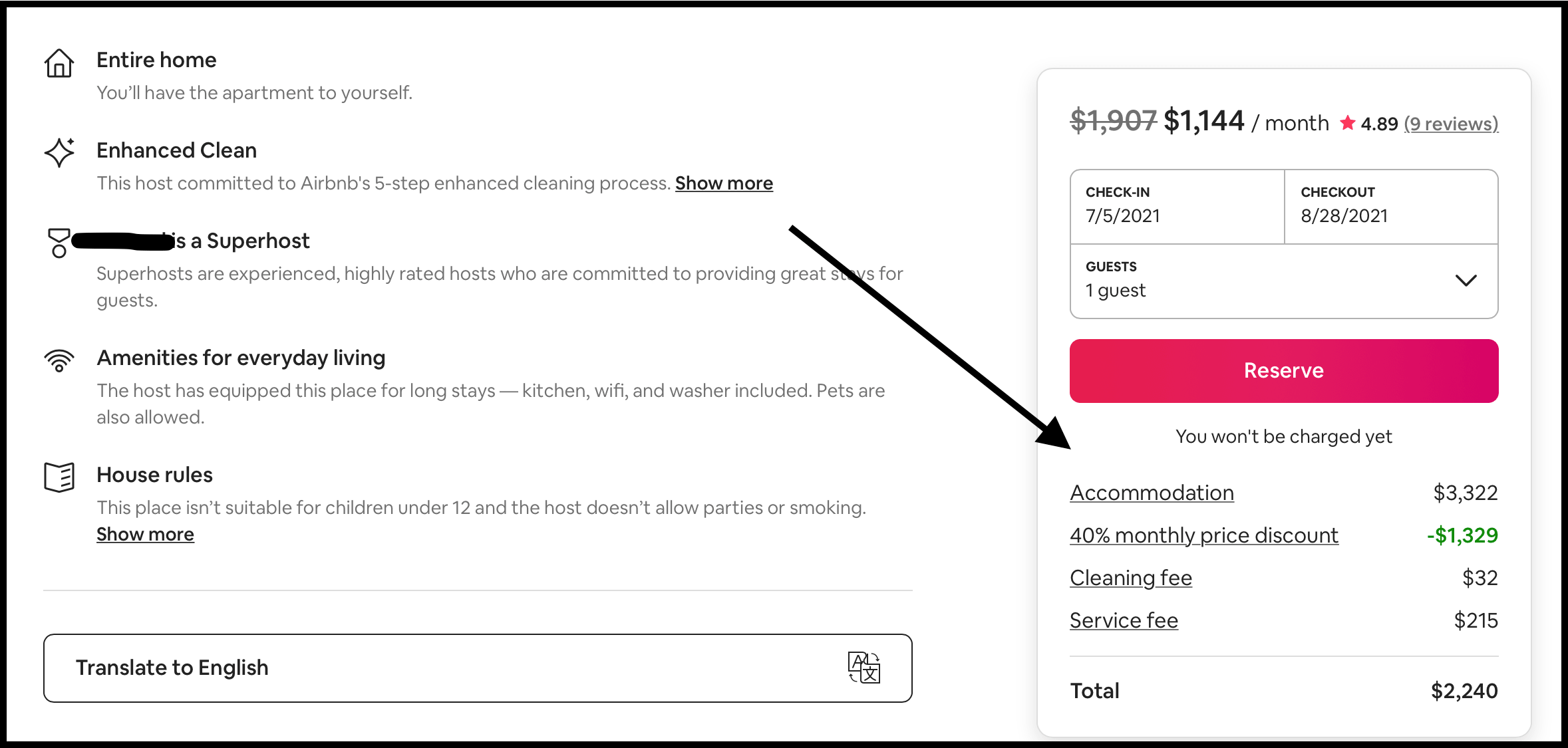

This is actually the size of the mortgage you desire instead of the latest property value the house or property you’re purchasing. Therefore, should you have a good ?30,000 deposit (otherwise collateral) additionally the value of the house or property are ?300,000, might you need ?270,000 of a lender to buy that property. Thus, their LTV rates could be 90% since you possess 10% out-of ?3 hundred,000.

Which is a pretty highest LTV price as an effective ten% put is recognized as being quite low. Getting a lender to help you lend you ninety% away from an excellent property’s worth is possible however, just remember that , the least expensive deals are offered to people with large deposits.

If you have ever been into the an assessment web site and you can viewed mortgage loans that have most useful rates in the event that LTV is gloomier, this is exactly why. Afterall, if a bank lends you less, it might treat smaller regarding unlikely enjoy which you default (do not repay) your mortgage.

How do i determine it?

You could assess the LTV ratio by the dividing the mortgage count from the worth of the property we need to purchase, following multiplying one to from the 100.

The number you happen to be left which have was shown given that a percentage. Thus, if you are buying a property really worth ?250,000 as well as have a deposit of ?50,000, you’ll need to rating a mortgage off ?two hundred,000.

Just what impacts this new LTV rates I could score?

https://paydayloanalabama.com/ridgeville/

Constantly, the reduced the latest LTV rate, the greater for your pockets. With a lesser LTV does mean you slow down the amount of financing you need however, to accomplish this, you want a much bigger deposit.

LTV is not the simply procedure to consider once you lookup within yet another financial whether you’re a primary-go out customer, homemover otherwise purchase-to-help property manager. It is additionally vital to believe:

Bring credit rating as an instance. If you have a shaky credit score that have tabs on late repayments, overlooked repayments or even worse, a loan provider sometimes see you given that an excellent riskier borrower and consequently, they may not be happy to give your more substantial loan i.elizabeth. a home loan with high LTV rate.

To demonstrate that you’re dedicated to the borrowed funds also to meet the requirements for a loan provider, you may have to cut a larger deposit or convey more guarantee at the rear of your. When you’re that’s challenging, it can indicate a diminished loan and quicker home loan repayments and that would-be healthier if you have struggled indebted during the the past.

Leave a Reply